Friday, March 31, 2006

School Property Tax Forum April 6th

School Taxes have become a Quality Of Life issue

And we can't count on School Boards to do anything about It

WHEN: Thursday, April 6th, 7:30 AM to 9:30 PM

WHERE: Huntington Hilton

598 Broad Hollow Road, Melville, NY

Long Islanders For Educational Reform (LIFER) is holding a public forum lay aside the myths of how we fund our schools and who is responsible to pay for what, to help taxpayers (and, hopefully, legislators) understand Albany's role in the school financing process, and to form a strategy that will allow homeowners to live on Long Island, if not affordably, then at least without fear of being forced to move.

This is a homeowner civic meeting. ALL homeowners are invited and encouraged to attend!

The Speakers will include:

NYS Senators Ken LaValle & John Flanagan

NYS Assemblymembers Marc Alessi & Charles Lavine

Business Leaders Bruce Bent & E. Christopher Murray

Civic Leaders Pat Byrne, Laura Pandelakis & Frank Russo

The Moderator will be Peter Kohler of Cablevision

LIFER has no affiliations with unions or School Boards.

If you want to remain on LI and want our children to line here also, check out LIFER. It is time to take control over the quality of education and taxes. Homeowners must organize the same way teachers and administrators do. Membership is LIFER is free.

LIFER, Long Islanders for Educational Reform, was organized in 2005 to address the issue of escalating school taxes, while maintaining excellence in our educational systems. Drawn from business, education, civic organizations and other groups of concerned citizens, the organization is committed to finding an equitable solution to the problem of burdensome taxation.

Visit LIFER at www.lischooltax.com or Contact info@lischooltax.com

LIFER offers free start up, recruitment & organizational expertise, websites and support to any homeowners' group or individuals that want to start a civic association.

If your group consists of 10 or more people and you wish to reserve seating at the April 6th forum, call 516-767-9179. For directions to the Huntington Hilton call 631-845-1000.

- - -

Click HERE to read The New York Times article on the State's School Aid Formulae, School Aid: Meet The New Math, Same As The Old

Click HERE to read the Newsday report on the April 6th forum, Turning The Wheels of Education

Thursday, March 30, 2006

I Should Have Stayed In Queens

By Patrick Nicolosi

There was a time not so long ago people made hard decisions to move their families from city life to a suburban life. I can remember the year my father and mother made their decision. The year was 1967, and after much protest from me (I even told them I was staying in Queens), we moved.

Now at first it was very hard, because back then moving to Long Island was like moving to the country, even here in Elmont there were remaining farms.

I still remember looking at the high schools and elementary schools and wondering if they were colleges or universities. All this land, all this grass, where is the asphalt? No more playing in the streets, no more running between cars, we now had parks and space to run and play.

The schools were clean and, for the most part, new. The streets were newly paved, and no one complained about taxes, the need for affordable housing, or crime.

What has gone wrong with that suburban dream of years ago? Why are some trying to change Long Island from the suburbs of New York to another borough of the city?

Most of us made our living in the city and came home to the peace and tranquility of our home in the suburbs. Some of our neighbors rented but they kept their homes clean and kept it to one apartment, unlike today where homes are now apartment buildings housing many families.

Recently I came across an old tax bill from 1980. The school tax bill for that year was under 700 dollars. Oil for my home was well under a dollar per gallon, and LILCO came to your home for no charge.

We had more police back then, in fact, almost double the force, and there was no talk about pedophiles living near our schools. Children delivered your newspaper and cut your lawns and we were happy to pay for those services. There were no men standing on corners making women and children feel unsafe. Why do we have to put up with this and why we are paying more, much more?

We are heading in the same direction as Queens and other parts of the city, the only difference is the tax and lack of transportation or infrastructure. Is this what we want for Long Island? Do we want to end a choice for many who seek a suburban life style?

We cannot be all things for everyone, land on Long Island does not grow or expand. We can't keep building without one day realizing the need to build toward the sky. We are now faced with many crises, most people are house rich and cash poor, and seniors can no longer afford this burden. The young can't afford a home unless it comes with rentable apartments or they are leaving for low cost states. The middle aged or baby boomers are also faced with leaving because there is no place to down size here on Long Island. The middle class has no representation and have more difficult decisions to make.

Some in Congress may believe this is "middle class," but here on Long Island anything under 100 thousand a year supporting a family is anything but middle, in fact, you are just getting by.

So now we need to give some serious thought to these subjects. Do we want another Queens? Do we want to fix our suburban dream?

The one thing that is almost certain, whichever direction we are heading, we will need to move from the regressive property tax to a more progressive tax based on one's ability to pay and not on one's land/house value. I would hope most want to retain a suburban lifestyle, or at the very least, to fix our towns so our women and children are safe.

I would also hope that when families make their decision to move to Long Island, it is based on the same decisions my family made many years ago -- a better life for their families and to keep their homes and community clean. We need to fix these problems, right now. Long Island is becoming a place you can't afford. Let's not make it a place you hate, and a place where you are paying more for less.

Patrick Nicolosi is a resident of Elmont and President of the Elmont East End Civic Club. This article originally appeared as a Letter to the Editor of the Elmont Herald, is republished with permission, and has been modified for this blog.

- - -

Hey Pat. Stop knocking Queens. Nassau County is not becoming Queens. It's becoming the Bronx. And Hempstead Turnpike is Tremont Avenue, without the elevated subway!

Okay, all you civic leaders. What say you about your community's future and that of our Long Island? Chime in any time. E-mail The Community Alliance with your thoughts, comments and Guest Blogs at info@thecommunityalliance.org.

Wednesday, March 29, 2006

Tell Me, Where Will The Children Live?

You may have seen the recent TV spots, or heard the commercials on local radio. The premise, that the children of Long Islanders must leave not only the nest, but the island itself, in large part due to the lack of affordable housing, sets the stage not for a political campaign, but rather, for a public relations blitz aimed at educating the public and moving Albany off of square one on the affordable housing front.

While some -- particularly those in Albany who favor the benign neglect of the status quo -- may view the local Campaign for Affordable Housing as Long Island's perfect storm, the convergence of three powerful organizations -- the Long Island Association, the Long Island Federation of Labor, AFL-CIO, and the Nassau/Suffolk Building and Construction Trades Council -- portends a significant movement form talking about affordable housing on Long Island to actually doing something about it.

Under the moniker of The Campaign For Next Generation Housing, the goals espoused are as follows:

- A series of media ads over the next several months encouraging Long Islanders to learn about Next Generation Housing and to better understand that it’s all about keeping our young people here on Long Island. [You will see TV commercials, you’ll hear radio commercials, and you will see ads in Newsday and other publications. All of those ads will direct you to the organization's website, www.nextgenerationhousing.com.]

- Meetings with civic leaders and boards of education members in each town on Long Island. Discussion of Long Island’s housing crisis with everyone who works to make their neighborhoods and school districts better places. Not to tell them what they should do, but to be sure they all understand what is happening to Long Island. To allow people in positions of influence on the Island to make informed decisions, and to assure that the information they have is complete and accurate.

- Presentations to local groups, such as Chamber of Commerce, PTA’s, Rotaries, Kiwanis, Lions, and other organizations. The organization will provide a speaker who can give group members a sharp, concise presentation about Long Island’s housing crisis, and what can be done about it. [If you are interested in having a presentation made to your organization, please click here.]

As part of its plan, the campaign supports legislation in Albany that advances the cause of affordable housing, with it's three component organizations cooperating on political support, including election strategy, endorsements and political fundraising -- points that have, in recent weeks, raised both eyebrows and ire among some incumbent legislators, particularly in the Republican-led Senate, which has dragged both feet and tail on measures designed to bring more affordable housing to the island. [SEE, Newsday editorial, The housing harangue.]

Residents -- who foot the bill for costs associated with the high costs of housing on Long Island -- are being asked to take an active role in the campaign [SEE, What You Can Do To Help], and, through the campaign's interactive interface, to let their voices be heard by public officials on the housing crisis and its ramifications.

The Community Alliance supports The Campaign For Next Generation Housing as well as the greater, broad-based Campaign For Affordable Housing, and urges everyone reading this blog to sign up and do your part to help make it possible -- and affordable -- for our children to stay on Long Island.

Click HERE to contact The Campaign For Next Generation Housing

- - -

Click HERE for Debunking The Myths About Affordable Housing

Click HERE to learn The Truth About Affordable Housing

Tuesday, March 28, 2006

Chris Fidis For Governor?

West Hempstead Resident Chris Fidis may not get on the ballot, but his ideas should at least get the ears of the candidates for New York's Governor, as they get a public airing here on The Community Alliance blog.

My name is Chris Fidis and I have been a resident of West Hempstead since 1988.

In 1992 I served on the West Hempstead schools citizen budget advisory committee. The committee's charge was to find ways to reduce the school budget.

We were told by then superintendent of schools Harold Silvers that if we can find something to cut our report should reflect those cuts as recommendations.

Well, our committee back then in 1992 found $450,000.00 to cut. We didn't have to cut any programs to achieve this kind of savings.

We were told by the school board at the time that we overstepped our charge. The truth is we were not supposed to find this money back then.

The West Hempstead school district is now, thanks to the current board and administration under Superintendent Carol Eisenberg, the most effective and cost conscious in the county.

The mentality that public school education is a free education is a really bad misconception. Someone is paying and footing the bill. At what cost do we tolerate this taxing of only property owners before we no longer have anyone who can afford to live in Nassau county?

Everyone must pay!

As school property taxes began to climb I contacted Senator Kemp Hannon's office after speaking with one of his staff in Garden City at the train station during his re-election campaign.

His staff member told me I had great ideas about reducing the school property taxes.

Senator Kemp Hannon proposed a change in the taxes I began to speak about back then.

I saw that my research was paying off.

On July 11th of 1999 I spent an hour in conversation with Michael Fabiano, the Budget Director for then County Executive Tom Gullotta. I informed him of a solution to the 50 million dollar deficit facing Nassau County back then.

The revenue collected from this new approach would have generated monies to close the gap without any new taxes imposed. But the county could not enact these changes because of what it would require to be put in place.

I worked on Mr. Suozzi's campaign and acquired over 7000 Greek American votes for this man.

Well today I am writing because I want to get my platform out in public view.

I visited the Board of Elections today and asked, how do I run for Governor and get on the ballot? I was told that I would need to collect 15,000 signatures across 15 voting districts state wide.

Well I know that would be impossible so I decided to contact The Community Alliance.

According to County Executives Mr. Levy and Mr. Suozzi, there is nothing that they can do about school property taxes.

I have personally spoken to Mr. Suozzi twice.

The first time was during a West Hempstead town meeting on the new vision for Nassau county.

I addressed the meeting and asked Mr. Suozzi back then "who is paying to live in Nassau County." He didn't know how to answer that question and asked me to contact his office.

The second time was during his walk along Nassau Boulevard while running for re-election.

I aksed the same question "who is paying to live in Nassau County?" And he still didn't get it.

The County Executive has done more harm than good for Nassau county.

The County Executive still doesn't get it today that there is a solution to the school property tax right here in our own back yard.

Nassau County is responsible for the proliferation of illegal apartments and allowing enforcement to go under funded. Yet Mr. Suozzi can give raises to staff and ignore what's important to his constituents. His answer is to go to Albany.

This is not the answer.

Albany should not be the scapegoat for not cleaning house here in Nassau County first.

Our elected officials either can't do anything or have a vested interest in leaving it as is status quo.

I have the plan that would do the following;

* Reduce the school property taxes by changing the current tax law which is broken.

* Place better controls on guardianship abuse in our districts buy using our districts free of charge.

* Change the current STAR funding formula and turn it into an educational grant for renter / non-property ownership.

* Give seniors the better benefit by eliminating STAR and only charging for a minor school tax for building maintenance ($250 - $500 a year ).

* Change the funding formula to allow the monies to follow the child regardless of school attended. Note - private schools, catholic schools are funded through school property taxes for books and transportation only. The remaining dollars should go to the teachers' salaries and not by default go to the district teachers salaries.

* I would require that district funding require not only proof of residence but proof of deed ownership. If the student is not from the homeowners family they should pay a non owner fee / or state sponsored educational grant i.e., former STAR program.

The basis of property taxes is ownership. If you own real estate you get taxed. If you don't own, "YOU DON'T PAY ANY TAXES"!

Mr. Suozzi's position is and has always been that homeowner pays the taxes, not the illegal renter. He is right in saying that. But, the homeowner subsidizes everyone who is not paying his/her fare share.

I want this inequity exposed and put on the table for the public forum. This can no longer be ignored.

I may not get elected Governor but I can make a good hard effort to get the issues on the table and give Mr. Spitzer and Mr. Suozzi a run for their money.

- - -

Anyone out there up to carrying Petitions to get Mr. Fidis on the ballot?

Let us try to sort this out, if we can.

First, whatever fault may lie with the County and it's administration, they are not "responsible for the proliferation of illegal apartments and allowing enforcement to go under funded." The scourge of illegal rental apartments, as it has been called, arises from a whole chain of economic events, aided and abetted not by the County's purported shortcomings, but rather, the failure of the townships to enforce their own Building Codes.

Case in point, the Town of Hempstead -- where illegal rental apartments in single family homes have been a growing Cancer for more than a generation -- had, until recently, only six (6) Building Inspectors to cover the entirety of America's largest township. This notwithstanding, some years back during the first term of the Suozzi administration, the Town of Hempstead literally turned away hundreds of thousands of dollars in funding for increased code enforcement.

It is the Town, not the County, that has primary jurisdiction over matters of zoning, building codes, and enforcement, and the Town that, on this score at least, must be held accountable.

Next, on the matter of home ownership as a basis for educating our children. New York State Education law requires school districts to provide an education to EVERY student residing within the district, whether his/her family owns, rents, or just stepped off the boat from Kuala Lampur without documentation and lives in a cardboard box on Hempstead Turnpike. That's Albany, NOT the County.

With respect to property taxes, we agree with Mr. Fidis when he says, "The basis of property taxes is ownership. If you own real estate you get taxed. If you don't own, 'YOU DON'T PAY ANY TAXES'!"

Yes, PROPERTY taxes are based on the ownership of PROPERTY! If you want to capture the renter -- illegal and otherwise -- and those who consume without recourse, you have to levy a tax on something other than property. Try INCOME! [As our State Legislators collectively cringe...]

We also agree, wholeheartedly, with phase one of the Fidis Plan -- "Reduce the school property taxes by changing the current tax law which is broken."

That means, fundamentally, changing the manner in which we fund our schools, establish and apply the State Aid formula, and distribute "wealth" among the State's school districts. In essence, that means we have to FIX ALBANY, because the State Legislature and the State Legislature alone is empowered to change the laws that, in effect, burden every Long Islander with an oppressive and regressive property tax!

The problem, Chris, is not Tom Suozzi's ambition (we could use more men and women of similar "ambition" in government), nor that the County Executive is running for the State's highest office in Albany. If Tom Suozzi as Governor could do for the property tax fiasco what he has done for Nassau County's finances as County Executive, we'd be in great shape. The problem is, simply put, there is no one running Albany.

We've long ago given up our State government to three men with personal agendas in what used to be a smoke-filled room (now there's just alot of hot air circulating within a vacuum), and have come to expect (we no longer demand) little progress on any front from either Governor or Legislature. That's the real shame.

Whether the ideas expressed here by Chris Fidis -- or any one of them -- will fly remains to be seen. Whether he will get many votes for Governor as a write-in candidate, his tax reform platform notwithstanding, is also uncertain. What is clear in all of this muddled repartee is that Mr. Fidis has taken the first -- and perhaps the biggest -- step toward cleaning up the property tax mess. Standing up. Speaking out. Making a case, for whatever it may be worth, for change.What's your opinion, and what steps are you willing to take to change the way we fund public education? The Community Alliance, the candidates for Governor, and your State Legislators, would like to know!

Monday, March 27, 2006

From Third World Country To America's First Suburb

What Bogotá Can Teach Baldwin

By Ellis Simon

Can Long Island’s aging suburbs learn anything about community design from the mayor of a burgeoning Third World city?

The problems facing middle-class communities like Baldwin, Bellmore or Bethpage “don’t amount to a hill of beans” when compared with those confronting places like Bogotá, Colombia, Nairobi, Kenya or Manila, the Philippines. Yet, they have overlapping concerns such as quality open spaces, walkability, traffic and environmental justice.

Last week, Enrique Penalosa, the former mayor of Bogotá and a candidate for President of Colombia, described for an audience of 500 at The City College of New York’s Great Hall how he transformed that city “from a symbol of chaos into a symbol of renewal.”

“Before you can decide what kind of city you want (to design), you want to first know how you want to live,” he said. “That gets into deep and complicated issues.”

Such decisions, he contends, should not be made through market forces. “Most people agree that the market economy is the best way to manage most of society’s resources, but it creates inequalities.”

As an example, he cites land distribution. “The supply of land doesn’t increase as the price of land rises. Hence it becomes an obstacle to solving housing needs and providing good public spaces.”

Penalosa views the quality of public spaces as an important quality of life issue. In public spaces, people meet as equals, regardless of their income levels, he notes. “Parks are not a luxury, but a necessity as important to quality of life as hospitals or schools. They should be great places that even the wealthy will want to go to,” he adds, citing New York’s Central Park as an example.

Another important issue for Penalosa was allocation of resources between the “haves” and “have nots” in his city of seven million, i.e. between those with cars and those without. “The more money we allocate for automobile infrastructure means less is available to meet the needs of the poor,” he notes. “Putting money toward cars uses it to make life better for the rich.”

In opting to build public spaces, schools, libraries and housing instead of more roads, not only did he side with the lower classes, who comprise 80 percent of Bogotá’s population, but he acknowledged the futility of highway construction as a tool for relieving traffic congestion. “Building infrastructure to solve traffic is like fighting a fire with gasoline,” he says. “As you build more highways, people just move further away.”

Instead, he initiated restrictions on auto use in the city’s central business district during peak hours and began construction of a bus rapid transit (BRT) system to replace the cities fragmented and stigmatized private bus lines. Today, 20 percent of the BRT system’s riders, are car owners, he says. When the system is fully built out, 85 percent of the city’s population will live within 500 meters of the nearest stop.

It is doubtful that someone with Enrique Penalosa’s credentials would follow the same playbook if he or she were occupying Kate Murray’s office. Our comparatively low population density makes us dependent upon the automobile, whether we like it or not. And, a relatively small percentage of our population lives in poverty.

However, as Penalosa points out, the more friendly a city is to cars, the less friendly it is to people. Our auto addiction comes at a price. It detracts from our quality of life and happiness by keeping us isolated and away from public spaces where we can partake in one of our greatest pleasures, watching other people.

Is it any wonder that the regional malls like Roosevelt Field and Green Acres have become our new town squares? As any teen can tell you, they are among the few great year-round people-watching places we have.

But the inclusiveness – or lack thereof – of privately owned malls creates a problem for Penalosa. In a democratic society, it is important that people not feel excluded or inferior, he maintains. “It is not bad to be poor, but it is bad to feel inferior.”

Ellis Simon is a resident of Oceanside.

- - -

Assuming the grass is greener -- or at least less trampled by cars -- let's not downplay that Bogota, Columbia has a darkside, too. Drug trafficking, civil strife, narcoterrorism, and abject poverty are but a few of the concerns faced by capital city citizens. Or so the CIA Factbook would have us believe!

Friday, March 24, 2006

Downtown Baghdad?

What's your vision for "downtown" revitalization?

From Elmont to West Hempstead, Freeport to Wantagh, "downtown" and "Main Street" are poised to make a comeback. Can they? Will they? And if there is a "vision" of the future of our suburban communities, whose vision will that be, and what form shall evolve out of the visioning process?

What do you see, and what will the neighborhood be? E-mail The Community Alliance at info@thecommunityalliance.org so together we can forge New Visions for America's First Suburb!

Thursday, March 23, 2006

What If The School Property Tax Was Unconstitutional?

A general diffusion of knowledge being essential to the preservation of the liberties and rights of the people, it shall be the duty of the Legislature of the State to establish and make suitable provision for the support and maintenance of an efficient system of public free schools.

-Texas Constitution, Art. 7, sec. 1

Deep in the heart of Texas there may be some real heart after all. The State's Supreme Court, upholding (in part) a lower court ruling, determined that the existing system of setting tax rates -- which, by reason of a statutory cap coupled with legislative and constitutionally imposed mandates, essentially disenfranchises local school districts of any meaningful discretion in setting tax rates -- violates the Texas Constitution. [Click HERE for analysis of lower court decision.]

The Texas Supreme Court, in its discussion, stated, "The Legislature’s decision to rely so heavily on local property taxes to fund public education does not in itself violate any provision of the Texas Constitution, but in the context of a proliferation of local districts enormously different in size and wealth, it is difficult to make the result efficient — meaning 'effective or productive of results and connot[ing] the use of resources so as to produce results with little waste' - Compensation must be made for disparities in the amount of property value per student so that property owners in property-poor districts are not burdened with much heavier tax rates than property owners in property-rich districts to generate substantially the same revenue per student for public education... Also, many districts have been created as tax havens — lots of property and few students — allowing property owners to escape paying their fair share of the cost of public education in Texas and making it more difficult to achieve efficiency. The result is that substantial revenue is lost to the system. If the property in these and similar districts were taxed at substantially the same rate as the rest of the property in the state, the system could have hundreds of millions of additional dollars at its disposal. Whether this additional revenue were used to increase the attainable equalized funding level, ease the State’s burden, or lower the tax rate each district must impose, the system would be made more efficient simply by utilizing the resources in the wealthy districts to the same extent that the remainder of the state’s resources are utilized. A system that operates with an excess of resources in some locales and a dearth in others is inefficient..."

Disparity. Inequity. Inefficiency. Sounds alot like the way we finance education here in New York, doesn't it? Tack on unfunded State mandates, and the hands of local school districts, particularly here on Long Island, are all but tied.

The Decision of the Texas high court was not a broad nullification of school funding under the State Constitution, there being no finding that the entire system is either inefficient or unsuitable. Rather, as courts often do, the court's ruling narrowly held that "the State’s control of local taxation for education amounts to a state property tax in violation of article VIII, section 1-e" of the Constitution. [The Texas Constitution prohibits a State property tax. While Article VIII, sec. 10 of New York's Constitution sets specific tax limitations on real property, there is no prohibition, per se, of a state property tax.]

Ironically, given that Texas is typically last in education, the Texas Supreme Court quotes the landmark decision of the Supreme Court of the United States in Brown vs. Board of Education:

Today, education is perhaps the most important function of state and local governments. Compulsory school attendance laws and the great expenditures for education both demonstrate our recognition of the importance of education to our democratic society. It is required in the performance of our most basic public responsibilities, even service in the armed forces. It is the very foundation of good citizenship. Today it is a principal instrument in awakening the child to cultural values, in preparing him for later professional training, and in helping him to adjust normally to his environment. In these days, it is doubtful that any child may reasonably be expected to succeed in life if he is denied the opportunity of an education. Such an opportunity, where the state has undertaken to provide it, is a right which must be made available to all on equal terms.

The court then cites San Antonio Independent School District v. Rodriguez, decided some thirty years after Brown, the first case to challenge the constitutionality of the public school finance system in Texas, wherein the nation's highest court stated:

The need is apparent for reform in tax systems which may well have relied too long and too heavily on the local property tax. And certainly innovative thinking as to public education, its methods, and its funding is necessary to assure both a higher level of quality and greater uniformity of opportunity. These matters merit the continued attention of the scholars who already have contributed much by their challenges. But the ultimate solutions must come from the lawmakers and from the democratic pressures of those who elect them.

Texas does not stand alone in holding that the financing of public schools through a property tax, by disparate formulae with inequitable results, is unconstitutional. New Hampshire's method of school funding through a property tax was found similarly flawed, the court saying that the law, as applied, fails to define or determine the cost of an adequate education and leads to unfair taxation. [SEE N.H. School Funding System Again Declared Unconstitutional.]

In our own front yard, New York's courts have held that the manner in which the State funds public schools -- at least in New York City -- is violative of the State Constitution, mandating a still to be implemented change in the State Aid formula. In Campaign for Fiscal Equity vs. State of New York, the Court of Appeals (NY's highest court) ruled that the New York State constitution requires that the state offer all children the opportunity for a "sound basic education." That was in 1995. Today, the disparity-gap in what is spent per student is as broad in actual dollars as there are school districts in actual numbers, and the equity-gap -- in terms of what the State gives in aid to each district -- continues to widen.

Article XI, section 1 of the Constitution of the State of New York reads as follows: The legislature shall provide for the maintenance and support of a system of free common schools, wherein all the children of this state may be educated.

"The legislature shall provide..." We read this provision as "the State shall pay for." "Maintenance and support..." We read that as "dollars and cents." "A system of free common schools..." Which part of "free" requires further definition? "Wherein all the children of this state may be educated." Now wouldn't that be nice?

It appears to us, from a literal reading of New York's Constitution (no creative judiciary required here), that there shall be no unfunded mandates, that the State must provide 100% of the financial support necessary to maintain our public schools, and that New York's "common schools" (which have been interpreted by the courts to include public schools K-12, and should, by right, include higher education in the State's public colleges and universities) are required, under the highest law in the Empire State, to be FREE!

We now look to New York's Legislature to meet it's constituional obligations to the people of our great State -- students and property owners alike. Failing appropriate remedy, and with no less deliberate speed than was mandated by the court in Brown vs. The Board of Education, we should again look to the courts, for just as separate educational facilities are inherently unequal, so too is the disparate funding of our public schools -- in method and in application -- inherently inequitable.

Wednesday, March 22, 2006

Whither The Property Tax?

A Point of View from the New York State School Boards Association (NYSSBA)

By Barbara Bradley

The issue of escalating school property taxes promises to take center stage in statewide political debates in 2006.

Several political figures have indicated their intention to tackle this issue, including a Long Island county executive who may run for governor. Republicans in the State Assembly have organized an Assembly Minority Commission on Alternatives to School Property Taxes.

Delegates to NYSSBA’s Annual Business Meeting in October referred to committee a resolution that would have directed NYSSBA to seek legislation to provide alternative funding methods for public education. A committee comprised of board members will meet with outside experts and make a report at the 2006 business meeting.

This isn’t the first time NYSSBA members have examined this issue. An ad hoc committee was convened in 1992 to study alternative means to fund education.

“Everyone wants to study an alternative to the property tax because it doesn’t account for personal income,” said David A. Little, NYSSBA’s director of governmental relations. “But we are concerned in any shift of taxation that local community residents remain involved in the budget process.”

The issue is particularly hot on Long Island, where more than a third of school budgets failed on the first ballot this year. Right after his November re-election, Nassau County Executive Tom Suozzi announced he would launch a campaign with school boards and county officials to help reduce school property taxes in Nassau County.

Suozzi, a Democrat and a possible candidate for governor, according to published reports, said that residents in his county have identified school property taxes as a key issue. “We have to start building a consensus that this is the number one problem we face on Long Island and we have to find a solution,” he said.

Long Island property values have risen so dramatically in the past 20 years that many homeowners couldn’t afford to buy their own homes now, according to a 2004 report by the Nassau County comptroller. This increase in property value, combined with a countywide reassessment, has driven up local property taxes and driven down Long Island’s share of state aid to education. State aid is based on income and property wealth.

“For the first time in my 30 years as a school administrator, I hear repeated stories of increasing numbers of parents voting against their own kids’ school budgets,” Valley Stream Superintendent Marc F. Bernstein wrote in Newsday.

Suozzi is slated to meet with Nassau County school board presidents and vice presidents on Dec. 7. According to a letter sent by Suozzi, the discussion will include ways to get Long Island districts their fair share of state aid and to help districts reduce their costs.

Meanwhile, fears of an organized “property tax revolt” in Erie County went unrealized. Of the 29 Erie County school district budgets up for vote in May, only three were defeated on the first ballot.

In November the Erie County Legislature agreed to a 15 percent property tax hike, coupled with a sales tax increase to 8.75 percent, the second highest in the state. Oneida County has the highest sales tax in the state at 9.5 percent, New York City is 8.375 percent, while in Nassau and Suffolk counties the rate is 8.625 percent.

Meanwhile, Republican legislators have created the Assembly Minority Commission on Alternatives to School Property Taxes. Members including Chris Ortloff of Plattsburgh have been traveling the state soliciting alternative ideas to fund education. Among the ideas suggested thus far have been:

- Reducing reliance on property taxes but not totally phasing out property taxes.

- Implementing a “flat rate” income tax and/or sales tax to support public education.

- Capping school property tax increases.

- Reducing the number of state property tax exemptions.

- Ortloff has also proposed legislation that would limit residential real property tax assessments for primary residences to the present inflation rate or 3 percent, whichever is lower, and not to exceed 10 percent over five years.

Other legislators who have proposed legislation include:

- Assemblyman David Hooker (R-Schoharie), who has called for an Education Finance Reform Task Force to study how to transition education funding from real property tax to a combination of income and sales taxes.

- Sen. John Bonacic (R-Orange), who would allow voters to choose to abolish the school property tax on primary residences, shift the local share of education costs to an income-based system, and create county school boards that would disseminate the proceeds to school districts within the county.

“The property tax has provided a stable base for funding education,” wrote Little in NYSSBA’s legislative memo on the Bonacic bill. “While incomes may fluctuate within a school district over time, real property remains relatively consistent in the appreciation of its value.”

With Gov. George Pataki not seeking a third term, several Republican gubernatorial hopefuls have emerged. William Weld has proposed an “Empire State Taxpayers’ Bill of Rights,” according to published reports.

Weld, a former Massachusetts governor, would limit state taxes “under a formula using the previous year’s level and factoring in inflation and annual population growth,” according to the Associated Press. Half of any surplus would go to taxpayers; half would go to a “rainy day fund.” Weld has also called for a constitutional amendment to cap local property tax levies to 2.5 percent of a community’s total property value, according to the Associated Press.

Other states have used such caps. Since 1992, Colorado has had legislation limiting the state’s spending growth rate to the rate of inflation plus annual property growth. However, voters lifted the cap in November to direct excess tax revenue to education, health care and transportation projects, according to Education Week.

California’s Proposition 13, which limits the real estate tax on a piece of property to 1 percent of its purchase price until the property is resold, is the oldest such cap in the nation. It stemmed from a California Supreme Court ruling in the 1970s that ruled the state’s property tax-based finance system for schools was unconstitutional.

Fast forward to 2005, where just last month the Texas Supreme Court ruled the state’s finance system for education – in essence, a statewide property tax – was unconstitutional and directed the state legislature to find an alternative solution.

However the issue is ultimately resolved in New York, “the pressure would be taken off local property taxpayers if the state would pay its fair share,” Little said.

The writer is Deputy Director of Communications and Research for the New York State School Boards Association. This article first appeared in the NYSSBA's On Board Online on December 5, 2005, and is republished here with permission.

- - -

In Related News:

League of Women Voters Launches Study on Education Funding

It was in October of 2004 that Nassau County Assessor Harvey Levinson first suggested that we begin the debate, in earnest, on the issue of school property taxes. That debate, which, of necessity, must take place primarily in Albany -- with the full participation of the Governor and the Legislature -- has only now begun locally, while whithering on the legislative vine at the State Capitol.

A Commission has been formed by the Suffolk County Legislature to seek reasonable alternatives to school funding, an initiative that enjoys bi-partisan as well as bi-county support. [Click HERE to read Joye Brown's, Property-Tax-Relief Bandwagon Gets a Push.]

In Nassau, Trustees from 40 of the County's 56 school districts have banded together hoping to rouse Albany's patron saints of perpetual dysfunction, and County Executive Tom Suozzi, in the midst of a campaign that he hopes will take him from the County Seat to State Street, has made a pledge to fix "crushing" property taxes.

So, what is our role, as citizens and residents, in all of this? As homeowners and taxpayers, we hold the greatest stake in the outcome. With every State Senator's and Assemblymember's seat on the line this November, we have the final up or down vote. We are empowered to bring an end to the tyranny of the school property tax!

It for for us to let our legislators know -- starting today -- that we are holding them accountable. It is for us -- right now -- to light the fires under our elected representatives in Albany, compelling them to do right by the people they serve, even if that means taking that tax bull by the horns and breaking the property tax grip that threatens to destroy the fragile economic's of Long Island's china shop.

Call, write, e-mail and/or visit the local offices of your State Senator and Assemblymember. Let them know you're watching -- and let them know that failure to act responsibly, and before the current session is adjourned, on school funding and the school property tax crisis is not an option.

Yes, let the debate begin. More than this, at long last, let the debate translate into appropriate action, lest both the school property tax issue, and every last dollar in our wallets, whither, and then, descend like a fallen leaf into the black hole of oblivion.

Tuesday, March 21, 2006

Park(s), Drive or Reverse?

Well, 2006 has gotten off to an interesting start as far as the Nassau County Park system is concerned.

The first $4 Million of the Environmental Bond Fund is slated for regular maintenance projects or landscaping studies in several parks both town and county. This is a misuse of these funds which were voted in to either acquire new properties for open space or new capital funded projects such as new playgrounds, etc. (Another $2 million does address new projects but no new acquisitions are listed.)

The County legislative majority confirmed the appointment of an unqualified new Commissioner of Parks, Recreation and Museums. Incredible! While Jose Lopez might be a great organizer of track meets, that activity is a miniscule part of park operations of which he admittedly knows little if anything. With the parks system collapsing from lack of personnel and supplies, the appointment of someone less than a proven expert in Suburban Parks is ludicrous. This also raises the issue that if Mr. Lopez was organizing the track evens for nothing, why are we now paying him $125.000 a year to do it now? This appointment follows the hiring of two new Deputy Commissioners, also unschooled in suburban parks. This dynamic trio joins 10 other Deputies and Special Assistants equally unqualified in the proper running of our park system. We truly believe that each of these individuals have greater value in a gubernatorial campaign than any suburban park system.

As we warned in 2000, The Cradle of Aviation Museum, despite its noble intent, would become another boondoggle if allowed to privatize. Management of the facility is in the 3rd group of hands and still large executive salaries and inadequate marketing have caused this public resource to fail. While the county retained most of the maintenance costs and unpaid volunteers do most of the work, the bloated management has bled the coffers dry. Now they are looking at the county to forgive $2.5 million in debt and hand over another half million so they can continue to operate. This is folly. The "Cradle" should be reacquired by the county immediately and turned over to the Museum Division of the Parks Department. The few paid employees should be county workers supplemented by the existing volunteers. Management should be in the hands of the new Deputy Commissioner of Museums, Stacey Kay, who could "earn his spurs" in turning this museum around.

Plans to turn over 13 county parks on the north shore to the Town of North Hempstead continue. This "theft" of parks acquired and paid for by all county residents should be scrapped once and for all. How about using some Bond Fund Money to rebuild the county's Hempstead Harbor Park? To have allowed this park to fall into such ruin is a disgrace and obviously designed to facilitate the transfer to North Hempstead.

Our county parks are in a state of collapse. The least concerned about this is the county administration who continues to starve the system of personnel (excluding Deputy Commissioners, of course), equipment and supplies. It is up to park users, their families, friends and neighbors to stand up and demand that the $68 million a year budgeted for parks is spent in parks. If not, where is that money going? Our suburban parks are an integral part of our lifestyle in Nassau County and they are being taken away from us. We will all be the poorer for it.

Bruce Piel

Chairman

Park Advocacy & Recreation Council of Nassau (PARCnassau)

246 Twin Lane East

Wantagh, NY 11793-1963

(516) 783-8378

- - -

Click HERE to read the Newsday editorial, Nassau's Land Preserve

Charleston Two-Steps Into Tomorrow

Take a trip to the Carolinas and you can't help but notice a few quality of life items worthy of note on this blog.

First off, no sooner does one leave Long Island do the roadways -- including the Interstates -- appear cleaner. Are we simply slobs here on the Island, or are municipalities more in tune with both task and tax dollar west of the Nassau County line?

Next, venture south of the Mason-Dixon line, and you'll find that the South did, contrary to popular belief, win the war. At least in terms of rebuilding and re-energizing communities -- whose relative age eclipses that of America's first suburb by some 200 years -- the reconstruction of southern towns and cities makes Nassau's plans to redesign the hub look like a kid with his first set of Lincoln Logs.

Take Charleston, South Carolina, for example. A historic town -- a city, actually, though it retains that "small-town" ambiance thanks to its architecture and walkability -- pre-dating the American revolution, with more than its share of blight and brownfields.

Take Charleston, South Carolina, for example. A historic town -- a city, actually, though it retains that "small-town" ambiance thanks to its architecture and walkability -- pre-dating the American revolution, with more than its share of blight and brownfields.There are, perhaps, few places in America more charming and picturesque than Charleston, and few "downtowns" that have risen to the occasion in reinvigorating both town center and suburb.

In fact, Charleston has, in recent years, become known as Charrette Central, residents and city officials giving serious mind to multiple visioning processes, severl of which have taken the leap from drawing board to Main Street.

A virtual laundry list of projects are now under consideration, with a host already completed and fluorishing.

Downtown Charleston itself is undergoing a renaissance of sorts (and I tell you, it look's nothing like Nassau's hub, where residents will be breathing down one another's necks in overpriced 2' x 4' units crammed side-by-side on a former raceway, overlooking the County's tallest structure -- the Ref-Fuel resource recovery plant). Over 1600 residents -- from the youngest school children to the city's senior set -- are taking part in Charrettes, and actually seeing their vision of "downtown" take shape.

Downtown Charleston itself is undergoing a renaissance of sorts (and I tell you, it look's nothing like Nassau's hub, where residents will be breathing down one another's necks in overpriced 2' x 4' units crammed side-by-side on a former raceway, overlooking the County's tallest structure -- the Ref-Fuel resource recovery plant). Over 1600 residents -- from the youngest school children to the city's senior set -- are taking part in Charrettes, and actually seeing their vision of "downtown" take shape.Revitilization and Development

Completed in 2000, The South Carolina Aquarium, showcases exhibits of South Carolina's waterways from the mountains to the sea and includes thousands of animals and plants. Also completed in 2000, and located adjacent to the South Carolina Aquarium, is the new IMAX Theatre.

The Ashley River Walkway - a combination bikeway and promenade - is in the planning stages and will wrap around the eastern side of the Peninsula. Ultimately, the Walkway would link the new City baseball stadium, just north of Brittlebank Park on the Ashley River, with the South Carolina Aquarium

A major catalyst in the City's revitalization was the completion of Charleston Place in 1986. This luxury hotel/retail complex draws a steady stream of customers to its shops as well as to neighboring stores and restaurants along King, Meeting and Market Streets. With the Hampton Inn redevelopment, the refurbishment of the stately Francis Marion Hotel and the conversion of the old Citadel into Embassy Suites, this area is experiencing a resounding boom. A well-appointed landmark, Marion Square Park is undergoing a redesign and will be entirely surrounded by development successes and two revered churches.

In 1991, Charleston opened the gates to its Visitor Reception and Transportation Center (VRTC) on Meeting Street. The VRTC represents a significant alliance of historic preservation and tourism management. It is housed in an 1856 railroad freight station. In the renovation of the structure, the City has salvaged the rustic feel of the old depot - original beams and pine floors still greet the Charleston visitor.

Several other developments enlivened the City and secured its position as a wonderful place to live. In 1990, the City completed the Waterfront Park - an eight-acre linear park and pier along the Charleston Harbor entry. The park masterfully combines spectacular fountains, spacious lawns, intimate garden "rooms", plenty of walking and jogging paths and a long wharf with picnic tables and wooden swings. Additional waters-edge projects afford greater public access to the water, including the Charleston Maritime Center, which will establish a permanent home for the shrimping industry and include a special events pier with public access to the water.

Another extraordinary economic opportunity avails itself as a nearby sixty-five acres, known as Union Pier, offers prime development sites for hotel, retail, office and residential, deep in the historic district. A full complement of boulevards, parks and vistas are planned to ensure an ambiance befitting the historic district.

Housing

Charleston's signature housing type is the "'single house" - a narrow house with gracious side piazzas. The single house is but one choice in an ample range of housing indigenous to Charleston. From marshfront condominiums to downtown studio and from four-bedroom homes to splendid mansions in the historic district, every domestic setting can be realized. Charleston's single family market is strong; since 1987, single family production has averaged 310 new homes annually, and multi-family construction averages at 30.4 units per year.

For years, Charleston has made national headlines for its innovative approaches to providing affordable housing. In addition to the award winning designs, the achievements include the incredible rebirth of the central city and a strong revitalization movement northward up the Peninsula and into the neck area. Through its Community Development Division, the City has provided over 2,000 housing units since 1990. The Charleston Housing Authority manages 10 public housing areas as well as 113 units which are scattered throughout the City. The task of providing affordable housing does not fall to City agencies alone. A variety of groups like Habitat for Humanity, Charleston Affordable Housing, Humanities Foundation, Charleston Crisis Ministries, many churches and dedicated individuals offer assistance in the quest to provide decent, attractive, affordable housing and to prevent homelessness. This production task force is leading the way by generating creative financing and design solutions.

For years, Charleston has made national headlines for its innovative approaches to providing affordable housing. In addition to the award winning designs, the achievements include the incredible rebirth of the central city and a strong revitalization movement northward up the Peninsula and into the neck area. Through its Community Development Division, the City has provided over 2,000 housing units since 1990. The Charleston Housing Authority manages 10 public housing areas as well as 113 units which are scattered throughout the City. The task of providing affordable housing does not fall to City agencies alone. A variety of groups like Habitat for Humanity, Charleston Affordable Housing, Humanities Foundation, Charleston Crisis Ministries, many churches and dedicated individuals offer assistance in the quest to provide decent, attractive, affordable housing and to prevent homelessness. This production task force is leading the way by generating creative financing and design solutions.Culture and the Arts

Throughout its history, Charleston has stood as a cultural capital of the South. The performing arts are well represented here with a symphony orchestra, community theater groups and several local ballet companies performing regularly. The Gibbes Museum of Art and numerous art galleries, along with the abundant examples of architectural excellence and craftsmanship, expose residents and tourists to the visual arts. The Charleston Museum, the oldest museum in North America, offers a captivating collection of artifacts depicting lowcountry life from the time of the first settlers through the twentieth century.

One thing that struck me about Charelston is the comprehensive nature of the city's revitalization plan. There actually is a Master Plan which incorporates what would otherwise appear to be the piecemeal rehabilitation of aging neighborhoods. More than mere pavers and street lamps, Charleston has thrown itself -- no, immersed itself -- in the rebirth of a nation's founding community as a 21st century leader in smart growth.

- - -

Yes, the south shall rise again. Indeed, it is, in Charleston, South Carolina. The question we have at The Community Alliance is, will Nassau County rise again -- or will we simply continue to sprawl from blight to brownfield, from spot attempts at revitalization to visions of light rail lines and towering lighthouses, from villages and hamlets caught hopelessly between nowhere and no place to that suburban utopia we can happily (and affordably) call "home?"

Write to us with your vision of the New Suburbia. info@thecommunityalliance.org

Monday, March 20, 2006

Suozzi's "New Suburbia" Gets A Forum

Proposal Includes Renovated Coliseum, Extension of Islanders’ Lease, Minor League Baseball Stadium, Next-Generation Housing, and Transit Improvements

Mineola, NY- Nassau County Executive Thomas R. Suozzi announced that the proposal from the Lighthouse Development Group meets each of his seven core goals for the redevelopment of the Nassau Veterans Memorial Coliseum Site, and lays out a plan that is consistent with his vision for “New Suburbia.

Among the highlights of the Lighthouse Development Group’s $1.6 billion proposal are: a $200 million renovation of the Nassau Coliseum; a commitment from the Islanders NHL team to stay until 2025; a canal lined with retail shops and mixed-use residential-commercial development; the creation of a pedestrian-friendly ‘Nassau Centre;’ an investment in a transportation system; the construction of a minor-league baseball stadium and the development of next generation housing.

“After a thorough, competitive and open review process, my evaluation team has chosen the Lighthouse Group’s proposal,” Suozzi said. “Their plan stood up against top-notch competition, and emerged as the best of the best. It matches the vision I’ve been talking about for ‘New Suburbia.’ We can look forward to a new minor-league ballpark, a renovated Coliseum, new housing and office space that will create excitement at the geographic heart of Nassau County and create an engine for economic growth. And we accomplish this at no cost to the taxpayers, while significantly increasing the tax base.”

The project is expected to generate approximately $160 million in net new taxes through 2025.

In February, Suozzi’s evaluation committee – Deputy County Executive Helena Williams, Counsel to the County Executive William J. Cunningham, III and Executive Commissioner of Planning Patricia Bourne – winnowed four proposals down to two. The committee decided that the Lighthouse Development Group best addressed each of the County Executive’s seven core goals in transforming the site into an attractive, vibrant, lucrative and multiple-use center. The Lighthouse proposal met or exceeded Suozzi’s core goals for the Coliseum site, including:

Renovating or replacing the current Coliseum building into a world-class sports and entertainment facility, at no cost to the county.

About $200 million is earmarked for a dramatic overhaul of the Coliseum, including two new buildings to be incorporated into the Coliseum’s existing structure. The new buildings will house a basketball court, additional ice rinks, a fitness center, new locker rooms and other sports facilities. The Coliseum will also have expanded seating capacity with an additional 2,500 seats, including ice-level luxury boxes.

Minor League Baseball Stadium The group also proposes to build – at no cost to the county – a new minor-league baseball stadium at the nearby Mitchel Field Athletic Complex, and to bring a minor league baseball team affiliated with the Atlantic League to the county. The proposed stadium will be subject to its own request-for-proposal and approval process.

Construction of structured parking adjacent to the Coliseum to free up land – currently used as parking lots – for other development. Some $120 million will go toward the construction of Coliseum parking decks.

Extending the Islanders lease beyond its 2015 expiration, or making a deal with a comparable sports franchise.The Lighthouse Group will extend the Islanders’ commitment to play professional hockey in Nassau County until 2025.

Creating a mixed-use commercial-residential development. Townhouses, apartment buildings and office buildings will be constructed around a picturesque canal, to create a pedestrian-friendly suburban center.

Creating next-generation housing. The Lighthouse Group will commit 20% of any new residential units to next-generation housing.

Expanding the tax base for Nassau County, the Town of Hempstead and area school districts. New retail businesses and office space, as well as new residential units, will significantly expand the county’s tax base, kick starting new growth that Nassau needs to offset escalating property taxes.

Creating a public transportation system to connect the Coliseum site with the greater area known as the Nassau County Hub.The Lighthouse Group has committed to spend $55 million on transportation improvements in the ‘Nassau Centre’ area, including $25 million toward transforming the Centre into a pedestrian-oriented suburban center. The group will also fund a bus-trolley system serving the Coliseum and its immediate surroundings, as well as bus service to connect with the LIRR.

The county’s request-for-proposals sought plans for the 77-acre Coliseum site, but the Lighthouse Group’s proposal includes plans for surrounding properties as well, resulting in a 150-acre vision. The Lighthouse Group owns properties adjacent to the 77-acre site, including the Marriott Hotel, Reckson Plaza and the Omni Office Complex. The proposal includes 6 million square feet of hotel, retail, office, residential and Coliseum space.

Additionally, an extra $5 million is included in the proposal for community facilities, including proposed sponsorship for a Long Island Sports Hall of Fame.

The Lighthouse Group’s control of adjacent properties, plus its ability to guarantee that the Islanders would continue to occupy the newly renovated Coliseum were factors in their selection, Suozzi said. “This proposal makes the best possible use of the Coliseum site,” Suozzi said. “As the nation’s oldest suburb, the county really has no room left to grow. It is vital that we come up with new, creative ways to increase our tax base. This plan does that, while making the Coliseum site and the Nassau Centre an exciting place to live, work and play.”

County officials now will work to reach a Memorandum of Agreement (MOA) with the Lighthouse Group that would set out the major terms of the deal and establish a period for lease negotiations. Once a MOA is reached, it will be submitted for approval to the Nassau County Legislature. The plan also will need approval from the Town of Hempstead, which controls zoning issues at the site.The county is hopeful that construction could begin at the site within two years.

- - -

Hmmm. Required approvals from the Nassau County Legislature AND the Zoning Board of Appeals of the Town of Hempstead? Let the games begin!

With Peter Schmitt earlier saying that Suozzi's State of the County address left him "underwhelmed," you know that politics will take center stage in Mineola. Look for more trips to the penalty box at the County Seat than at the Coliseum.

And approval from the Zoning Board of the Town of Hempstead? The new-found amity between Tom Suozzi and Kate Murray aside, the clash between the Democrat controlled County and the redevelopment of the Hub.

Will the grandiose plans to re-energize the county's ailing and aged economy and infrastructure with mixed-use housing, retail and recreational space actually take flight at what was once Mitchel Field, or, like so many redevelopment plans of the past, simply fade from view, like Lindberg's Spirit of St. Louis as it ascended into the haze above the Hempstead Plains en route to Paris?

Will we tackle the problems of traffic, congestion, unbridled growth and overdevelopment along the Hempstead Turnpike corridor, or face the next generation of gridlock, increased pollution, density run amuck, and still further degradation of the water supply?

Let's not forget about NIMBY enthusiasts, who will be out in force declaring war against light rail, lighthouses, and any glimmer of light at the end of the proverbial tunnel. [Funny. Few NIMBYers were to be heard from during the "visioning" stage.]

And what of the taxpayer? Will this Nassau Centre really mean more money for our schools and less taken from the pockets of homeowners, or will we simply be creating more long-term debt and cost overruns -- along with anticipated projects that never get further than the drawing board -- feeding the already stretched taxpayer to the proverbial lions at a spanking new Coliseum.We want nothing more than to see Tom Suozzi's vision of a New Suburbia move forward, and for that groundbreaking ceremony to be held within two years. Still, we must proceed with a cautious optimism in assessing the Wang proposal and in fine tuning it's details. Similarly, we must reconcile the projected expenditures with our ability to pick up the hefty tab -- both in today's dollar's, and tomorrow's.

We want to be absolutely certain that we can, 10 or even 20 years down the road, look back at the creation of this Nassau Centre and say, "The rebith of America's first suburb began here," and not, "It seemed like a good idea at the time!"

What do you think about the Wang/Reckson plan to redevelop Nassau's "Hub?" Inquiring minds want to know. E-mail The Community Alliance at info@thecommunityalliance.org. Guest blogs on this issue are welcome and invited!

Saturday, March 11, 2006

A Time Out At The Community Alliance Blogspot

A brief late-Winter, pre-Spring hiatus to catch our breath and recharge our batteries.

Friday, March 10, 2006

If You Want School Aid Equity, Write A Letter

Suozzi, school officials complain about state aid inequity

MINEOLA, N.Y. Dozens of school board members joined Nassau County Executive Tom Suozzi today in urging the state Legislature to change the formulas for how state school aid is distributed.

Suozzi, who is seeking the Democratic nomination for governor as a reformer, says county taxpayers are getting a raw deal when it comes to school aid.

He says Nassau County has 7.45 percent of the students in the state, but it receives only 3.89 percent of total state aid for schools.

In a letters to Governor Pataki and state legislators, Suozzi and the school board members claim that Nassau County school districts should be receiving approximately 600 million dollars more.

He says the state school aid formula fails to take into account "regional cost factors" on Long Island and that people who bought their houses years ago and are "house rich" but "income poor" and cannot afford the school tax burden.

Copyright 2006 Associated Press.

- - -

Click HERE to see the News12 report. [Watch the video.]

- - -

The Long Island Association's Mitch Pally says that the State's purported $4 billion surplus should be earmarked for education, with half of that to go to Long Island's schools.

State Senator Dean Skelos, the Senate's Deputy Majority leader and head of the Long Island delegation, says Suozzi is simply making "political hay" in his run for the Democratic nomination for Governor.

"Political hay?" Maybe so. That's what politicians -- from Skelos to Suozzi -- do.

But hay is for horses, Dean. It is obvious to everyone that Long Island's school districts aren't getting anything close to their fair share of the State Aid pie. Go back to Albany, on behalf of Long Island's taxpayers, and tell your colleagues to "show Long Island the money!"

Meanwhile, kudos to Nassau County Executive Tom Suozzi. When was the last time that anyone got the leaders of 40 Nassau school districts together on the State Aid issue, at the same place, at the same time, and, literally, on the same page? BRAVO!

- - -

A copy of the Letter to the Legislature will be posted as soon as it is made available for publication. More to follow. . .

He's As Mad As Hell. . .

Call for a little more outrage, and not only does that window open wide, but in flies Pat Nicolosi -- resident rant artist extraordinaire -- belting one out for everyone to hear.

The perfect segue to yesterday's Network piece, here is community as seen from Pat's Perch, in a corner of The Community Alliance we like to call, Nicolosi's Niche. . .

Glad to see everyone from County Executive to Town Supervisor working together, but before we celebrate, let's look at theory and reality.

In theory, the atomic bomb was developed to secure peace, in reality it escalated war. Albert Einstein stated had he known the outcome of his invention he would have never gone forward. Now that doesn't mean someone else wouldn't have invented the bomb, it means Einstein's theory for peace wasn't a reality.

Which brings me to the point of the Empire Zone. In theory, it will help bring business here, and a strong commercial base will help stabilize or reduce the tax burden. However, looking at Long Island and communities with a strong commercial base, that theory is far from reality.

Look at Oceanside, Farmingdale, Uniondale and other communities with strong commercial tax bases -- homeowners in those communities still complain about school tax increases every year.

The next part of the Empire Zone which no one seems to mention is, where will people live? Most business groups on Long Island are finding it hard to keep the young, educated work force for lack of affordable housing. Now, I am against just building for the sake of building, because unless we get control of property taxes, which is the driving force behind Long Island being unaffordable, building or using the term "affordable housing" is an oxymoron.

Let's look more critically at this new tool -- are seniors and the middle aged looking for jobs? Well maybe, but more universally, we are looking for tax breaks and consolidation of wasteful taxing districts.

Are the young looking for better, higher paying jobs -- the answer is yes. Here on Long Island, however, what might be considered a good paying job elsewhere, hardly pays the bills here.

Take a job, starting pay 50 thousand a year. Sounds great. On Long Island, for a young person starting out, it would be hard making ends meet. After state and federal taxes, that young person might be left with around 2 thousand clear a month. After rent about, 12 hundred, and car insurance and gas and food, and you can clearly see where this is heading. And let's not forget to mention college loans.

Politicians have a way of using euphemisms to make it sound like they are doing something when, instead of confronting the main issues head on, they skirt around them. They use phrases like Education President, War on Drugs, War on Poverty, School Accountability Bill, Nail and Mail and so on, and the question still remains, what has changed?

We are still complaining about taxes and we will be doing that long after the Empire Zone, or any other term, is enacted because unless they confront the issue head on nothing will change.

You want to reduce taxes, then you have to consolidate. You want to reduce or get rid of school property taxes, then you will have to change the way we fund education. You want to make Long Island affordable for everyone, then you will have to come up with a plan to rid us of the waste and realize there is no need to run Nassau County, the Town Of Hempstead, and all the other over 400 taxing districts like it's 1930 all over again.

Now we have another tool in our arsenal of tools. In theory it sounds great. In reality, we will still have the high taxes and illegal housing issues before us. What should have been an ongoing maintenance plan from the Town with our roads and continued enforcement now needs fancy terms and gimmicks.

So we will watch and pray and let the pieces fall where they may, but my guess is we will still be complaining about the taxes, the young will still be leaving, and the illegal housing problem will still be ongoing. Oh, and the term "affordable housing" will still be an oxymoron. The only words that will work for us are Change and Consolidation.

-Pat Nicolosi

The writer is President of the East Elmont Civic Club, and a frequent contributor to this blog. This missive originally appeared in the Elmont Herald, and has been modified, with the author's permission, to fit this blog.

- - -

Okay, it's your turn to rant, to rave, to call the play-by-play of community. E-mail us at info@thecommunityalliance.org. Are you "as mad as hell and not going to take this anymore?" Then open a window and shout. At the very least, post a comment. It does a community activist good!

Solutions To Long Island's Problems ~ Real Simple

Last week, The Community Alliance received the following e-mail:

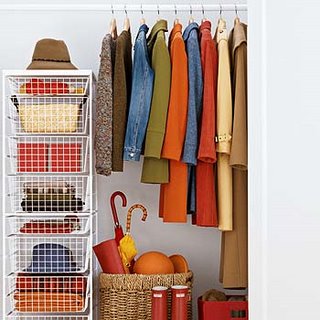

Real Simple is a weekly, “life strategy” series -- based on the popular magazine of the same name – that offers viewers simple, straightforward solutions to life’s everyday problems.

We are seeking Long Island area homeowners with disorganized home office desks, medicine cabinets, pantries, under sink cabinets – small but vital parts of your life that need Real Simple solutions – to appear in upcoming segments. We are planning to be in Rockville Centre at the end of the month.

Interested parties should send photos ASAP of their house exterior, organizational nightmare and family to Katie_kramer@realsimpletv.com.

Yup, Real Simple. The answer to the prayers of the organizationally challenged. Straighten the office desk, clean out the medicine chest, clear the clutter from your closet, maybe even sell all that 1950s crap you have crammed into the attic. A half hour under the glaring lights of television -- with a bit of dramatic flair to keep you glued to the set -- and voila, your pantries and undersink cabinets look like they've been visited by Hazel and Mr. Clean. Real Simple.

Yup, Real Simple. The answer to the prayers of the organizationally challenged. Straighten the office desk, clean out the medicine chest, clear the clutter from your closet, maybe even sell all that 1950s crap you have crammed into the attic. A half hour under the glaring lights of television -- with a bit of dramatic flair to keep you glued to the set -- and voila, your pantries and undersink cabinets look like they've been visited by Hazel and Mr. Clean. Real Simple.If only our problems here on Long Island could be so readily and summarily resolved, all within the neat confines of a half-hour television show. Maybe we don't need the intervention of either executive or legislature. Hmm. Could be all we need is a catchy reality show.

Here are a few ideas sure to "clean up" the mess on our Long Island, if only we could sell them to the networks:

Extreme Makeover: Workforce Housing Edition ~ Ty Pennington and crew descend on Nassau County, magically turning brownfields into affordable housing for Long Island's seniors and Generation Next.

Deal or No Deal ~ Long Islanders get to choose a briefcase. One contains enough money to pay property taxes. The other enough to put food on the table. The banker offers to take your house, leaving you homeless. You decide. Howie Mandel Weitzman hosts.

Lost ~ A plane crash leaves George Pataki, Sheldon Silver, and Joe Bruno stranded on a deserted Long Island, with no hope of escape until they reach agreement on the State budget. Tom Suozzi parachutes in with the fix.

Life Swap ~ A family from Long Island's Gold Coast switches places with a family from the forgotten south shore. The ultimate in culture shock.

Punk'd ~ Ashton Kutcher pranks Long Islanders into believing that their property taxes have been frozen, their roads have been fixed, and that Special taxing Districts actually save them money. Kate Murray makes a cameo appearance. Smile!

The Biggest Loser ~ Long Islanders compete to see who can pay the most in school property taxes. With so many contenders for the title, the series is expected to drag on for decades.

Growing Up Gulotta ~ The former County Executive reprises his long-running role as Nassau's chief honcho. Joe Mondello gives a compelling performance as an over-the-hill Tom Gulotta.

Big Brother ~ Dick Cheney really is watching!

The Honeymooners ~ Roger Corbin plays Ralph to Peter Schmitt's Norton. "To the moon, Lisanne."

Amish In The City ~ The Amish secretly take up residence in the Five Towns. Who knew?

I Want To Be A Hilton ~ Charles Wang laments the loss of his coliseum cum lighthouse.

Lost In Space ~ A modern-day revival of the 60s series, sans robot. The Nassau County Legislature leads an ensemble cast through misadventures in the ozone layer.

Fear Factor ~ Just the thought of living on Long Island.

Surreal Life ~ Need we say more?

So there you have it. Long Island's many crises averted. Real Simple. That's a wrap, folks.

Consult your cable listings for local programing, and, by all means, do contact Katie Kramer of Real Simple at Katie_kramer@realsimpletv.com.

Learn how to build an environmentally-friendly home. Discover the only pots and pans you'll ever need. Get handy tips to organize your car. And for goodness sake, straighten out your desk, will ya? It's so messy, you can't even find that #&*$@! property tax bill!

Thursday, March 09, 2006

"I'm As Mad As Hell, and. . ."

I made a conscious decision last Sunday that I wasn't going to watch the 78th running of the Oscars, the prospect of seeing Jon Stewart fall flat on his face notwithstanding.

I made a conscious decision last Sunday that I wasn't going to watch the 78th running of the Oscars, the prospect of seeing Jon Stewart fall flat on his face notwithstanding.Instead, I made the trek over to the local Blockbuster and rented Network, the 1976 Paddy Chayefsky flick that had everyone "mad as hell" and opening windows.

The film won four Oscars, including a posthumous award to Peter Finch, the "mad as hell" Howard Beale who demanded of his television audience that they exhibit more outrage.

Finch never lived to see us get up, run to the windows, and scream at the top of our lungs, "I'm as mad as hell, and I'm not going to take this anymore." I wonder, will any of us live to see the day when Long Islanders are sufficiently pissed, driven to their windows, and moved to scream?