Like The Plagues That Beleaguered Generations Past; Like Locust And Pestilence Upon Our Fields; Like The Blood On Our Doorposts And The Slaying Of The First Born; So, Too, Is The Saga Of Local Government -- The Pharohs Of Our Time

Its that time of year again, folks. Yes, those "special" trucks at Sanitary District 1 will be rolling through the streets of the Five Towns next week, picking up the leftover bread during the Passover holiday.

This will mark the third consecutive year that The Community Alliance blog has run our Passover Story -- a new tradition in blogdom much like A Christmas Story has become to post-Thanksgiving television.

Unlike the real story of Passover, which tells of the exodus of the Jews from the land of Egypt and celebrates the freedom of all people from the yoke of enslavement and oppression, this Passover story is yet to have a fortuitous ending.

Indeed, our long march through the desert that is the realm of the special taxing districts has only just begun, with no oasis in sight, and the oppression of the Pharohs -- be they reincarnated in the form of Joe Mondello or Kate Murray, or as the original April Fools joke, Nat Swergold, Counsel to Town of Hempstead Sanitary District 1 and purveyor of fine matzo everywhere -- continues, unabated.

Why, just this week The State Comptroller's Office has released the report "Town Special Districts in New York: Background, Trends, and Issues."

The report analyzes the growth in special districts, details how special districts are structured, and compares the geographic concentration of these districts. The report also contains a county-by-county breakdown of the total number of special districts, the total amount of revenue raised and the impact on taxpayers. Click HERE to access the report.

There are no surprises. Nothing new, really. And guess which county tops the list of Special District revenues and leads the way in Special District burden/property taxes per household? [How'd you guess?]

State Comptroller, Tom DiNapoli, finds that “the revenue raised for special district services represents nearly one quarter of total revenues raised by towns,” and asks, “should residents be charged at different rates for substantially the same public service based on where they live in a town?”

Of course they should be charged more! Why, they enjoy paying more. And just think of what it costs to add those "special" trucks to pick up the bread at residents' backdoors during Passover. . .

- - -

A Passover Story

Why Is This District's Garbage Collection Different From Any Other District's Garbage Collection?

The following story, first blogged on March 9, 2005, drew so much attention, not to mention critical acclaim, that we simply had to run it again. [In fact, several regular readers specifically requested a reprise.]

We all know the outcome of the Nassau County Comptroller's audit of the infamous Town of Hempstead Sanitary District 1. A $700 steak dinner for 4, and what was characterized as a "total lack of financial control."

Of course, things have changed dramatically in Sanitary District 1 since last year's audit. Well, at least one thing has changed -- THE TAX RATES! Now Sanitary District 1 residents pay even more to "enjoy" their back door trash pick up.

Dont you just love it?

The Bread Of Our Affliction

A Passover Story, As Told By Counsel For Town Of Hempstead Sanitary District 1

An article appeared in a recent edition of the Nassau Herald on the subject of the Nassau County Comptroller's pending audit of several of the Special Districts, including Sanitary District 1. [We are reprinting the article below in its entirety, because you simply cannot make this stuff up!]

Commenting on the services provided by the Sanitary District, Nat Swergold, the chief counsel for Sanitary District 1, said "The district... accommodates the large Orthodox Jewish population in the area by arranging for special trucks during the eight holy days of Passover so bread can be disposed of, since observant Jews do not eat bread during the holiday."

Now, don't get us wrong. We appreciate the great lengths our Sanitary Districts go to in order to serve the public, but "special trucks during... Passover" to collect the bread?

What next? The fire districts placing extra fire trucks in service just in case the horse radish on the gefilte fish burns the roofs of our mouths? Or maybe the water districts will pump in extra water to our homes to help wash down the matzo?

Let's face it, Jews, be they Orthodox, Conservative, Reform or unaffiliated, are not hording bread prior to the holiday. Indeed, most Jews, logic dictates, try to consume the bread they do have in the house before Passover. Assuming any bread remains, most Jews we know, clean the house of bread BEFORE the start of the holiday, and not, certainly, "during the eight holy days" referred to by Mr. Swergold.

Just what are these "special trucks" picking up?Is this the best counsel for the Sanitary District can offer up as a raison d'etre for these Special Taxing Jurisdictions? If so, we've only one word for him: Gevalt!

One has to ask, do we really need three garbage collection days, a recycling day, a bulk pick up day and a yard waste pick up day, keeping in mind that it is Town Highways, not the Sanitary Districts, that sweeps our streets (all too infrequently) and plows the snow. Why - and we’re embarrassed to say this - there are some days when we have absolutely no trash to put out at the curb. Are we eligible for a rebate?

It doesn't take an Einstein - who, by the way, celebrated Passover in a secular vein - to realize that the existence of the Sanitary Districts, and other Special Districts within the township, cannot be substantiated "as is," and the cost to run these districts - special trucks for Passover aside - cannot be justified. At least not with a straight face. Why, in Sanitary District 6, we only have six Commissioners, shy of the ten required for a Minyan!

Clearly, what the Sanitary Districts are trying to put over on the taxpayers amounts to nothing less than unmitigated chutzpah.

According to Andrew Parise, the Mayor of Cedarhurst (which is in Sanitary District 1), "Curbside service wouldn't fly here." You mean to tell me they're picking up garbage at the door? [And here we are, in Sanitary District 6, paying twice the rate for mere curbside service.]

We just have two simple questions: (1) How many Sanitary District Commissioners does it take to change that dim light bulb over the head of the unwittingly inane Nat Swergold, and (2) How long will we, the taxpaying homeowners of the Town of Hempstead, allow ourselves to be played for fools?

- - -

FROM THE NASSAU HERALD:

Sanitary district audit planned County comptroller plans to explore consolidation of garbage pickup

By Andrew Coen

In an effort to save county residents money on the taxes they pay for services like garbage pickup and water, Nassau County Comptroller Howard S. Weitzman has announced plans to begin auditing some of the more than 400 special taxing districts throughout the county.

Sanitary District 1, which services the Five Towns and small portions of Lynbrook and Valley Stream, is among the five districts to be audited and considered for consolidation with other areas.

Other districts that will undergo audits include Sanitary District 2, which encompasses Baldwin, South Hempstead and Roosevelt; District 6, which takes in Elmont, North Valley Stream, Franklin Square, West Hempstead and Lakeview; the Port Washington Garbage District in the Town of North Hempstead, and the Syosset Sanitary District in the Town of Oyster Bay.

The districts were selected for audits based on criteria such as high tax rates, large accumulated surpluses and high tax increases in 2004-05, the comptroller said.According to Weitzman, along with residents paying village, town and county taxes, there are nearly 400 sanitation and water districts with 1,600 different tax rates, amounting to a "hidden government" that adds to the already heavy tax burden. Weitzman said he would like to explore the feasibility of town governments' consolidating some of the special districts to save taxpayers money and operate them with greater efficiency."

The growth of these special districts reflects the haphazard development of Nassau County in the last century, from a collection of unassociated towns, villages and hamlets," said Weitzman.

"Some of [these districts] may be necessary and some may be well-run, but the persistence of so many separate governmental authorities, with their own employees and tax rates, tends to hide the true cost of local government and contributes to our high local tax burden."

Nat Swergold, the chief counsel for Sanitary District 1, said he does not see his district meeting any of Weitzman's criteria for an audit, since, Swergold said, the district does not have a high surplus, has one of the lowest tax rates in the state and has not had any hefty tax increases. "We are probably a target for this audit because we are the largest [sanitary district]," said Swergold, adding that Sanitary District 1 services more than 30,000 households.

According to Swergold, last year's tax rate for single-family residences in District 1 was $12.58 per $100 of the assessed value of a home, which is half the rate of District 2 ($24.62 per $100) and District 6 ($26.05 per $100).

"[District 1's] tax rates are much lower than the rest of the districts," said Cedarhurst Mayor Andrew Parise. "I don't know who would provide better service than we get here."

Swergold said that while he welcomes an investigation into his district, because it is well run, he does not think the audit is necessary, since the state comptroller audits the district periodically. He added that he could not envision any sort of consolidation of the areas to save money, since each sanitation district has different needs. "I think [consolidation] is not a good idea, because each area and each district is unique," said Swergold, who has been the attorney for District 1 since 1972. "There is no way we could keep these services if there were consolidation."

Swergold said that District 1 is unique compared with other sanitary districts, in part because its workers pick up trash in the rear of residents' homes, which means residents do not have to place garbage curbside unless they are disposing of heavy items. The district operates its own recycling plant in North Lawrence and, as a result, has the highest recycling rate of any sanitary district in the state, according to Swergold. The district also accommodates the large Orthodox Jewish population in the area by arranging for special trucks during the eight holy days of Passover so bread can be disposed of, since observant Jews do not eat bread during the holiday.

"Curbside service wouldn't fly here," Parise said of the unique services offered to residents in District 1.

According to Weitzman, the goal of the audits is to provide a better understanding of the districts'expenditures, hiring and procurements practices and the efficiency of their operations. He said that additional audits of other special districts in the county would be considered depending on how the initial examination goes.The comptroller's decision to initiate audits follows a January report by County Assessor Harvey Levinson that showed that many special taxing jurisdictions, like garbage and water districts, spend millions of dollars each year with little observation by the public. The report prompted Levinson to call on the comptroller to audit those districts in the county.

"Homeowners who pay widely different tax rates for the same services within a town are entitled to know how their ever-increasing tax dollars are spent," said Levinson. "I am confident that Comptroller Weitzman's independent examination of sanitation districts operating within the towns will lead to sensible cost-cutting measures, consolidation or possibly even the elimination of these unnecessary invisible governments."

The planned audits have the support of some top state officials, including Comptroller Alan Hevesi, Attorney General Eliot Spitzer and Assembly Speaker Sheldon Silver. "In beginning these audits, Comptroller Weitzman is addressing the need for greater public oversight of these taxing districts," said Hevesi. A 2002 audit of some of these special districts by then state Comptroller Carl McCall found that several districts kept unreasonably high reserve balances.

Weitzman's audits will examine administrative and operating expenses and the appropriateness of fund balances.Comments about this story? ACoen@liherald.com or (516) 569-4000 ext. 210.

- - -

And the story continues. The NYS Comptroller's audit of Sanitary District 1 found major transgressions (still denied by Nat Swergold & Company), and the Nassau County District Attorney's office is conducting it's own investigation (begun under Denis Dillon) to see if any Sanitary District 1 Commissioner, employee, or contract worker engaged in criminal conduct.

Meanwhile, those observing Passover who would like to have a truck sent to their homes to pick up bread may call Sanitary District 1 at 516-239-5600. Tell them The Community Alliance sent you! [Passover observers residing outside Town of Hempstead Sanitary District 1 can call 1-800-I-GOT-BREAD for pick-up. Ask for Kate.]

Friday, March 30, 2007

Thursday, March 29, 2007

Property Tax "Relief" In Sight For Nassau Homeowners?

Ah, We Dont Think So!

News12 Long Island reports that a property tax "freeze" is in the works for Nassau County, with the County Legislature's minority leader, Peter Schmitt, calling for a 5-year "freeze," and the Chairman of the County Board of Assessors, Harvey Levinson, saying that, at most, the County can afford a 2-year "freeze."

Click HERE to see report, Tax relief may be in sight for Nassau homeowners.

We don't have our Webster's at hand, but the last time we looked, "relief" wasn't defined as a "freeze."

In fact, you offer relief from sky-high property taxes by lowering them -- or at least shifting the burden to non-regressive taxes -- and not by holding the taxpayers in the unenviable position in which they now find themselves -- heads under water and drowning fast.

If I'm the poor bloak with a brain tumor that's causing every bodily function to shut down, I need relief in the form of removing --or shrinking -- that tumor, not "freezing" it in place, hoping that my vital signs miraculously stabilize, as a ventilator breathes for me, a dialysis machine filters the poisons out of my blood, and I struggle to survive the night.

Telling that guy in a vegetative state, "hey, it won't get any worse?" is little solace. How about, "we're going to make you better, and here's the medicine you need to get well!"

Medicine? All we get are platitudes and placebos!

According to News12, Schmitt says he wants to put an end to stealth taxes and give residents a chance to catch their breath.

"Stealth taxes?" That wouldn't be code for special taxing districts, would it Pete?

"A chance to catch our breath?" Great! Of course, it would help if you would get that pillow off of our faces.

Yes, Nassau County residents are in dire need of property tax relief. And we spell that, R-E-L-I-E-F, not F-R-E-E-Z-E.

Eliminate, consolidate, economize and downsize. Those are the starters.

More bang for the buck and fewer hands in our pockets.

We need to attack the invasive property tax virus at its very core, not merely treat the symptoms with a shot of novacaine.

And when is a freeze not a freeze?

Even Peter Schmitt, with apparent limited attention span and but nominal intellectual capacity, has to understand that a "freeze" in the assessment does not necessarily equal a "freeze" in tax rates -- rates established by fire districts, water districts, sanitary districts, school districts, and so on down the line.

Do the simple math: A freeze in assessment + an increase in the tax rate = HIGHER PROPERTY TAXES.

Maybe we're missing something. Then again, maybe not.

All the freezes in all the towns and all the counties throughout the State won't amount to a hill of beans -- or to so much as an extra dollar in the pockets of Nassau's homeowners.

It is, as Peter Schmitt called Tom Suozzi's move to take County cars away from certain County employees, nothing more than window-dressing!

News12 Long Island reports that a property tax "freeze" is in the works for Nassau County, with the County Legislature's minority leader, Peter Schmitt, calling for a 5-year "freeze," and the Chairman of the County Board of Assessors, Harvey Levinson, saying that, at most, the County can afford a 2-year "freeze."

Click HERE to see report, Tax relief may be in sight for Nassau homeowners.

We don't have our Webster's at hand, but the last time we looked, "relief" wasn't defined as a "freeze."

In fact, you offer relief from sky-high property taxes by lowering them -- or at least shifting the burden to non-regressive taxes -- and not by holding the taxpayers in the unenviable position in which they now find themselves -- heads under water and drowning fast.

If I'm the poor bloak with a brain tumor that's causing every bodily function to shut down, I need relief in the form of removing --or shrinking -- that tumor, not "freezing" it in place, hoping that my vital signs miraculously stabilize, as a ventilator breathes for me, a dialysis machine filters the poisons out of my blood, and I struggle to survive the night.

Telling that guy in a vegetative state, "hey, it won't get any worse?" is little solace. How about, "we're going to make you better, and here's the medicine you need to get well!"

Medicine? All we get are platitudes and placebos!

According to News12, Schmitt says he wants to put an end to stealth taxes and give residents a chance to catch their breath.

"Stealth taxes?" That wouldn't be code for special taxing districts, would it Pete?

"A chance to catch our breath?" Great! Of course, it would help if you would get that pillow off of our faces.

Yes, Nassau County residents are in dire need of property tax relief. And we spell that, R-E-L-I-E-F, not F-R-E-E-Z-E.

Eliminate, consolidate, economize and downsize. Those are the starters.

More bang for the buck and fewer hands in our pockets.

We need to attack the invasive property tax virus at its very core, not merely treat the symptoms with a shot of novacaine.

And when is a freeze not a freeze?

Even Peter Schmitt, with apparent limited attention span and but nominal intellectual capacity, has to understand that a "freeze" in the assessment does not necessarily equal a "freeze" in tax rates -- rates established by fire districts, water districts, sanitary districts, school districts, and so on down the line.

Do the simple math: A freeze in assessment + an increase in the tax rate = HIGHER PROPERTY TAXES.

Maybe we're missing something. Then again, maybe not.

All the freezes in all the towns and all the counties throughout the State won't amount to a hill of beans -- or to so much as an extra dollar in the pockets of Nassau's homeowners.

It is, as Peter Schmitt called Tom Suozzi's move to take County cars away from certain County employees, nothing more than window-dressing!

In Albany, They Still Play 'Let's Make A Deal'

School Aid Restored; Health Care Cuts Curtailed; April 1st To Bring On-Time Budget; Details Still Hammered Out Behind Closed Doors By Three Men In A Room

Word from Albany has it that Long Island's school districts will continue to get their historical -- if not equitable and sufficient -- share of the State Aid pie, and the cuts to Medicaid reimbursement and health care threatened by the Governor won't nearly be as harsh as anticipated.

Indeed, we may have a Constitutionally-mandated April 1st budget in place after all, with the Legislature restoring, as it has done in years past, some $1 billion to the Governor's proposed budget.

So here we are. Day 87, and what has really changed in Albany?

A few new faces, here and there. A couple of in-your-face shouting matches. A little steamrolling along State Street. Not very much at all, truth be told.

For all the talk of reform, of transparency, of open government, we basically have fallen back to the very status quo that Albany has been all too comfortable with for the last 12 years.

Yes, the budget will be on-time for only the third time in twenty-three years. But query as to whether a late budget is better than a bad budget?

Guaranteed that, in the months ahead, we'll be moaning about the property tax, questioning this year's crop of member item grants, and watching our mailboxes for those thirty-two cent rebate checks.

Albany, but a glimmer in the eyes of lawmakers from its dysfunction of yesteryear, seems to rest, if uneasily, on a twist in the old baseball adage, "wait 'til next year."

Wait 'til next year for real reform. Wait 'til next year for real property tax relief. Wait 'til next year for those three men in that room to open the door and let in other voices, not to mention the cleansing light of day.

Unfortunately, most New Yorkers can no longer afford to wait. And, evidently, the more things change in Albany, the more they stay the same!

- - -

'Steamroller' in Albany Learns How to Concede

By Michael Cooper and Danny Hakim

ALBANY, March 28 — Gov. Eliot Spitzer brought a hard-charging style to Albany, taking on adversaries personally and directly, even lambasting lawmakers in their home districts. But the State Legislature knows how to play hardball too, and the rookie governor is having to meet them halfway on his first budget.

So after Governor Spitzer waged a lonely, bruising political battle to try to reduce Medicaid costs — and was attacked in millions of dollars of television ads paid for by the health care union and a hospitals association — he ended up agreeing to restore many proposed cuts as part of the budget deal he is hammering out.

In a news conference Wednesday afternoon, Mr. Spitzer claimed a victory of sorts, saying that the agreements he and legislative leaders had reached so far had given him much of what he wanted. But he acknowledged that he had had to alter many of his key proposals to win the support of lawmakers.

“The overall level of spending, obviously, it is a bit higher than I had initially wanted,” Governor Spitzer said. “As I’ve said to a number of you over the course of today, you do not turn a battleship inside a bathtub. It takes a bit more than one budget cycle to get us down to the spending levels we want.”

Talks are still under way as the governor and the Legislature struggle to meet the April 1 budget dealine. But both sides say the Legislature has succeeded in increasing Mr. Spitzer’s proposed budget by nearly $1 billion — about the amount it usually adds to a governor’s budget. And now lawmakers in both parties are questioning privately whether the governor’s alpha-dog style has been all that effective.

State Senator Joseph L. Bruno, the Republican majority leader, who led the main opposition to the governor’s budget and sometimes found himself at the business end of the governor’s public tongue-lashings, seemed pleased.

“You know, I’ve stated before and others have stated, when you want to talk about numbers — depends on how you count,” Mr. Bruno said at a hearing, to much laughter. “You understand that, I understand that, this governor’s learned it quickly.”

The counting was still not done on Wednesday night. While there were many areas still to be agreed on, the agreements drove total spending for next year up to more than $121.6 billion — making it the ninth-largest increase of state-financed spending in the last 40 years, according to the Empire Center for New York State Policy, a conservative policy group.

Civic groups — which have been largely supportive of Governor Spitzer so far — were decidedly cool to the few details that emerged from the budget negotiations. The Citizens Budget Commission, which praised many of the governor’s proposals, called the agreed-on Medicaid cuts “modest,” and said the price for achieving them was high in terms of increased spending overall.

Numerous civic groups complained about the secrecy of the budget talks, saying that it looked as if, in the rush to make the April 1 deadline, the governor would have to waive the constitutional requirement that gives lawmakers three days to study laws before voting on them.

There were many contentious issues left to be resolved — any one of which could derail the chances of passing a budget by Sunday. These included whether to allow more charter schools in the state, whether to add a nickel deposit to cans and bottles of non-carbonated beverages, whether to give a tax break to people who send their children to private and parochial schools, and whether to give pay raises to judges.

But in a number of areas, Mr. Spitzer argued that the agreements he won would yield dividends in the future, even if they did not look significant at first.

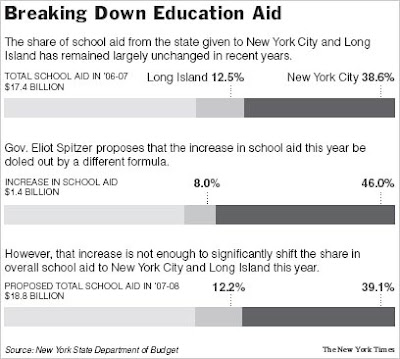

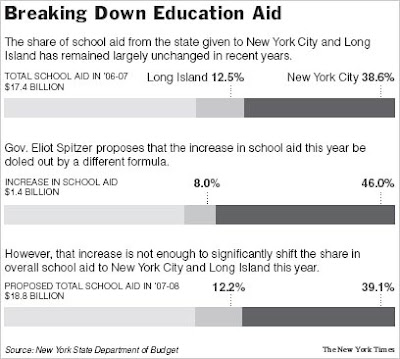

His plan to create a new school spending formula to send more money to New York City and other high-needs districts survived, with some significant changes. But the Republican-led State Senate got him to double the amount of operating aid being sent to Long Island’s school districts, and to increase aid to other wealthy districts.

This allows the governor to boast that he has boiled the state’s many arcane formulas down to one understandable, predictable formula, and that he has broken the historic system of dividing school aid by shares — a system that always gave New York City close to 39 percent of new school aid and Long Island between 12 and 13 percent.

Senate Republicans lost their fight to change the new formula to enshrine the current share system, but were nonetheless able to win an agreement to add $420 million outside the formula to make sure Long Island gets its traditional share next year.

“In terms of operating aid, what we call above the line, I believe our share will be at least what it was in the past” said Senator Dean G. Skelos, a Long Island Republican. “Maybe a little more.”

Still, even if shares survive in some form next year, analysts argue that the new formula is significant. “I think if you succeed in changing the formula through the statute — putting in place a new aid formula that actually breaks shares — that is significant,” said Edmund J. McMahon, the director of the Empire Center.

And when it came to the fight over health care spending — the biggest public battle of the budget — the governor said that he was restoring about $350 million out of his $1.3 billion in proposed cuts. Details were sketchy, but people with knowledge of the deal said the largest components involved restoring most of an annual inflation adjustment to Medicaid payments made to hospitals and nursing homes, and allowing the expiration of a tax on hospitals that he had proposed extending.

During the budget battle, the leaders of two powerful health care groups, 1199 United Healthcare Workers East and the Greater New York Hospital Association, were singled out for criticism by Governor Spitzer in front of hundreds of business and civic leaders at a power breakfast early this month. On Wednesday they gleefully sent out a news release claiming that the governor’s concessions would amount to the restoration of nearly 70 percent of his proposed cuts to hospitals and nursing homes.

But Mr. Spitzer said that “their 70 percent is just way off.”

“The hospital reductions are over 50 percent of what we had initially proposed, over 50 percent, and that is an important number,” Mr. Spitzer said.

But the governor won changes to how health care spending is distributed that he argues will yield benefits in time, and he got the State Senate to agree to pass a False Claims Act that he says will help Albany significantly recoup losses from Medicaid fraud.

The governor agreed to the Senate’s demand that property tax relief be sent directly to homeowners in the form of rebate checks. And while he held firm to his demand that it be focused on the middle class, he agreed to extend the relief to more high earners at the request of the Senate.

In the end Mr. Spitzer, who referred to himself earlier this year as a “steamroller,” did not flatten out everything in his path. He gave ground in some areas and won ground in others.

“There’s no steam in the roller,” State Senator Martin J. Golden, a Brooklyn Republican, said.

“You can’t do it on your own. I think he’s learning that.”

Nicholas Confessore contributed reporting.

Copyright 2007 The New York Times Company

- - -

Click HERE to read the Newsday story, Negotiations on Budget Deal

Word from Albany has it that Long Island's school districts will continue to get their historical -- if not equitable and sufficient -- share of the State Aid pie, and the cuts to Medicaid reimbursement and health care threatened by the Governor won't nearly be as harsh as anticipated.

Indeed, we may have a Constitutionally-mandated April 1st budget in place after all, with the Legislature restoring, as it has done in years past, some $1 billion to the Governor's proposed budget.

So here we are. Day 87, and what has really changed in Albany?

A few new faces, here and there. A couple of in-your-face shouting matches. A little steamrolling along State Street. Not very much at all, truth be told.

For all the talk of reform, of transparency, of open government, we basically have fallen back to the very status quo that Albany has been all too comfortable with for the last 12 years.

Yes, the budget will be on-time for only the third time in twenty-three years. But query as to whether a late budget is better than a bad budget?

Guaranteed that, in the months ahead, we'll be moaning about the property tax, questioning this year's crop of member item grants, and watching our mailboxes for those thirty-two cent rebate checks.

Albany, but a glimmer in the eyes of lawmakers from its dysfunction of yesteryear, seems to rest, if uneasily, on a twist in the old baseball adage, "wait 'til next year."

Wait 'til next year for real reform. Wait 'til next year for real property tax relief. Wait 'til next year for those three men in that room to open the door and let in other voices, not to mention the cleansing light of day.

Unfortunately, most New Yorkers can no longer afford to wait. And, evidently, the more things change in Albany, the more they stay the same!

- - -

'Steamroller' in Albany Learns How to Concede

By Michael Cooper and Danny Hakim

ALBANY, March 28 — Gov. Eliot Spitzer brought a hard-charging style to Albany, taking on adversaries personally and directly, even lambasting lawmakers in their home districts. But the State Legislature knows how to play hardball too, and the rookie governor is having to meet them halfway on his first budget.

So after Governor Spitzer waged a lonely, bruising political battle to try to reduce Medicaid costs — and was attacked in millions of dollars of television ads paid for by the health care union and a hospitals association — he ended up agreeing to restore many proposed cuts as part of the budget deal he is hammering out.

In a news conference Wednesday afternoon, Mr. Spitzer claimed a victory of sorts, saying that the agreements he and legislative leaders had reached so far had given him much of what he wanted. But he acknowledged that he had had to alter many of his key proposals to win the support of lawmakers.

“The overall level of spending, obviously, it is a bit higher than I had initially wanted,” Governor Spitzer said. “As I’ve said to a number of you over the course of today, you do not turn a battleship inside a bathtub. It takes a bit more than one budget cycle to get us down to the spending levels we want.”

Talks are still under way as the governor and the Legislature struggle to meet the April 1 budget dealine. But both sides say the Legislature has succeeded in increasing Mr. Spitzer’s proposed budget by nearly $1 billion — about the amount it usually adds to a governor’s budget. And now lawmakers in both parties are questioning privately whether the governor’s alpha-dog style has been all that effective.

State Senator Joseph L. Bruno, the Republican majority leader, who led the main opposition to the governor’s budget and sometimes found himself at the business end of the governor’s public tongue-lashings, seemed pleased.

“You know, I’ve stated before and others have stated, when you want to talk about numbers — depends on how you count,” Mr. Bruno said at a hearing, to much laughter. “You understand that, I understand that, this governor’s learned it quickly.”

The counting was still not done on Wednesday night. While there were many areas still to be agreed on, the agreements drove total spending for next year up to more than $121.6 billion — making it the ninth-largest increase of state-financed spending in the last 40 years, according to the Empire Center for New York State Policy, a conservative policy group.

Civic groups — which have been largely supportive of Governor Spitzer so far — were decidedly cool to the few details that emerged from the budget negotiations. The Citizens Budget Commission, which praised many of the governor’s proposals, called the agreed-on Medicaid cuts “modest,” and said the price for achieving them was high in terms of increased spending overall.

Numerous civic groups complained about the secrecy of the budget talks, saying that it looked as if, in the rush to make the April 1 deadline, the governor would have to waive the constitutional requirement that gives lawmakers three days to study laws before voting on them.

There were many contentious issues left to be resolved — any one of which could derail the chances of passing a budget by Sunday. These included whether to allow more charter schools in the state, whether to add a nickel deposit to cans and bottles of non-carbonated beverages, whether to give a tax break to people who send their children to private and parochial schools, and whether to give pay raises to judges.

But in a number of areas, Mr. Spitzer argued that the agreements he won would yield dividends in the future, even if they did not look significant at first.

His plan to create a new school spending formula to send more money to New York City and other high-needs districts survived, with some significant changes. But the Republican-led State Senate got him to double the amount of operating aid being sent to Long Island’s school districts, and to increase aid to other wealthy districts.

This allows the governor to boast that he has boiled the state’s many arcane formulas down to one understandable, predictable formula, and that he has broken the historic system of dividing school aid by shares — a system that always gave New York City close to 39 percent of new school aid and Long Island between 12 and 13 percent.

Senate Republicans lost their fight to change the new formula to enshrine the current share system, but were nonetheless able to win an agreement to add $420 million outside the formula to make sure Long Island gets its traditional share next year.

“In terms of operating aid, what we call above the line, I believe our share will be at least what it was in the past” said Senator Dean G. Skelos, a Long Island Republican. “Maybe a little more.”

Still, even if shares survive in some form next year, analysts argue that the new formula is significant. “I think if you succeed in changing the formula through the statute — putting in place a new aid formula that actually breaks shares — that is significant,” said Edmund J. McMahon, the director of the Empire Center.

And when it came to the fight over health care spending — the biggest public battle of the budget — the governor said that he was restoring about $350 million out of his $1.3 billion in proposed cuts. Details were sketchy, but people with knowledge of the deal said the largest components involved restoring most of an annual inflation adjustment to Medicaid payments made to hospitals and nursing homes, and allowing the expiration of a tax on hospitals that he had proposed extending.

During the budget battle, the leaders of two powerful health care groups, 1199 United Healthcare Workers East and the Greater New York Hospital Association, were singled out for criticism by Governor Spitzer in front of hundreds of business and civic leaders at a power breakfast early this month. On Wednesday they gleefully sent out a news release claiming that the governor’s concessions would amount to the restoration of nearly 70 percent of his proposed cuts to hospitals and nursing homes.

But Mr. Spitzer said that “their 70 percent is just way off.”

“The hospital reductions are over 50 percent of what we had initially proposed, over 50 percent, and that is an important number,” Mr. Spitzer said.

But the governor won changes to how health care spending is distributed that he argues will yield benefits in time, and he got the State Senate to agree to pass a False Claims Act that he says will help Albany significantly recoup losses from Medicaid fraud.

The governor agreed to the Senate’s demand that property tax relief be sent directly to homeowners in the form of rebate checks. And while he held firm to his demand that it be focused on the middle class, he agreed to extend the relief to more high earners at the request of the Senate.

In the end Mr. Spitzer, who referred to himself earlier this year as a “steamroller,” did not flatten out everything in his path. He gave ground in some areas and won ground in others.

“There’s no steam in the roller,” State Senator Martin J. Golden, a Brooklyn Republican, said.

“You can’t do it on your own. I think he’s learning that.”

Nicholas Confessore contributed reporting.

Copyright 2007 The New York Times Company

- - -

Click HERE to read the Newsday story, Negotiations on Budget Deal

Wednesday, March 28, 2007

Its Taxing Just Thinking About Special Districts

Imagine What Would Happen If We Actually Moved To Consolidate/Eliminate Them

Take a look at your 2006 Statement of Taxes/General Levy. By God, its enough to make an exorcist's head spin!

Sure, you've got your special taxing jurisdictions that everyone's been complaining about -- fire districts, water districts, sanitary districts. Those are the big "nuts" -- or so you thought.

Take a closer look.

In the unincorporated area of the Town of Hempstead served by Sanitary District 6, for instance, the total 2006 tax levy for that district was $21,587,424.49.

The total tax levy for the Town Refuse Disposal District -- paid by SD6 residents in addition to the SD6 levy -- was more than double the SD6 levy, topping $46 million.

If you live within garbage can throwing range of SD6, you're not only paying four times the going rate for collection, you're paying an additional $46 mil for the Town of Hempstead to dispose of what SD6 has collected.

That's some expensive trash you've got!

But that's not all.

Look at your tax bill again.

The Town Park District is costing taxpayers $32.8 million. Town Lighting District, $8.7 million. Town Parking District, a mere $43,000 -- no wonder you can't find a parking space!

And let's not forget the County Sewage Disposal District coming in at $39.2 mil.

Considering that all of these districts have, in one incarnation or another, their own strata of governance (be they designated as "commissioners" or otherwise), as well as their own rules of doing business (or not), the true cost to the taxpayer -- above and beyong what you see on your tax statement -- is staggering.

Do we really need a seperate Lighting District within the township, or a seperate Parking District in each unincorporated hamlet?

Over the decades, these special taxing districts have taken on lives of their own (beyond the "control" of even the governmental entities under whose name they operate and levy taxes), and, like cancer cells, have found their pervasive way into almost every aspect of our communal lives.

With limited oversight by Town, County and State, few internal constraints, and little if any effective input from the folks who foot the bills (that would be us), the special taxing districts have evolved into tax levy-sustaining fiefdoms, no longer serving the greater good, but merely perpetuating a system where the few serve themselves at the taxpayers' expense.

And so, the panels and commissions convene and opine -- all reaching similar conclusions, more or less: that most of the operations of the so-called special districts can and should be consolidated, and that many can and should be eliminated outright.

The potential savings to the taxpayers like the number of customers served by McDonalds -- billions and billions!

If only we could get past the "can and should" and reach the "are being and have been!"

Of course, there is a downside to consolidating and eliminating the special taxing districts. Imagine the hundreds if not thousands of special district workers -- those who thank the party for their patronage -- who would join the ranks of Long Island's unemployed.

Not to worry. We're confident that no show jobs with attendant six-figure salaries can be found for the disposed and the displaced at the County Seat or in Town Hall.

- - -

LI's 'special' districts draw scrutiny

By Michaek Rothfeld

michael.rothfeld@newsday.com

Nassau and Suffolk counties account for half of all revenue collected in New York State by special districts -- the small and relatively unknown government entities that operate in local towns with little oversight -- a new report by state Comptroller Thomas DiNapoli has found.

In Nassau, the $400 million collected by special districts -- for sanitation, lighting, water and other services -- represented 31 percent of the $1.3 billion statewide total in 2004, the year DiNapoli studied. The $240 million collected in Suffolk was 19 percent of the total that year.

In addition, tax-weary homeowners in Nassau paid an average of $946 for special districts, the most in the state in 2004 and more than 31/2 times the $257 average. Suffolk homeowners paid $512.

Nassau also had the distinction of being home to 15 percent of the state's garbage districts. And those 24 districts collected $181.1 million a year, 14 percent of all special district revenue in New York, the report said.

Special districts first began sprouting up around 1930 and have become more common over the last 50 years as suburban and rural areas have grown. They were put into place to provide services and bill taxpayers within small geographic areas.

But the districts, which now number 6,927, have become so ubiquitous and overlapping -- and often, secretive -- that they are coming under intense scrutiny. DiNapoli cited media reports about wasteful spending, such as a Newsday series in 2005 about spending practices in Long Island fire districts.

"While special districts give towns the flexibility they need to provide critical services to residents, they don't always operate as efficiently and equitably for all taxpayers," DiNapoli said.

In Nassau, nearly 52 percent of all town revenue is collected in special districts, adding hundreds of dollars to tax bills. In some cases, districts are independent of towns and have their own commissioners. In most cases, DiNapoli said, they are simply units of town government which collect revenue, either through property taxes or user fees, and operate on their own for a specific purpose. The cost of government has become a hot-button political issue. DiNapoli said New York has the third highest property taxes in the nation.

Gov. Eliot Spitzer has created a Commission on Local Government Efficiency to study consolidation. Nassau County Executive Thomas Suozzi is examining a potential consolidation of local taxing authorities. Suffolk County Executive Steve Levy is looking at sharing resources among school districts. And Nassau Comptroller Howard Weitzman has audited several special districts and highlighted poor accounting and spending practices.

"It is a much bigger problem here on Long Island than it is in the rest of the state," Suozzi said.

"This time next year, I'll have a solid, tangible result regarding what should be consolidated and how much money it will save."

DiNapoli, without taking a position on the issue, said the state could pass legislation requiring towns to undertake a consolidation study if, for instance, 65 percent of its population lived in an area serviced by more than one district with the same purpose.

Long Island is definitely at the epicenter of special districts in terms of revenue, but in quantity, the upstate counties of Erie, Onondaga and Monroe contain 34 percent of all state special districts, DiNapoli said. Suffolk has 200 and Nassau has 140 -- a combined 5 percent of the state total.

Copyright 2007 Newsday Inc.

- - -

Locally, Long Islanders can check out -- and become actively involved with -- a homegrown, grassroots effort to gain much needed control over the special taxing districts -- Residents for Efficient Special Districts. [Yes, a misnomer, as in, "the only efficient special district is an eliminated special district!"]

For more information on RESD, fill out and submit their online form, or send an e-mail to information@resd.info.

Take a look at your 2006 Statement of Taxes/General Levy. By God, its enough to make an exorcist's head spin!

Sure, you've got your special taxing jurisdictions that everyone's been complaining about -- fire districts, water districts, sanitary districts. Those are the big "nuts" -- or so you thought.

Take a closer look.

In the unincorporated area of the Town of Hempstead served by Sanitary District 6, for instance, the total 2006 tax levy for that district was $21,587,424.49.

The total tax levy for the Town Refuse Disposal District -- paid by SD6 residents in addition to the SD6 levy -- was more than double the SD6 levy, topping $46 million.

If you live within garbage can throwing range of SD6, you're not only paying four times the going rate for collection, you're paying an additional $46 mil for the Town of Hempstead to dispose of what SD6 has collected.

That's some expensive trash you've got!

But that's not all.

Look at your tax bill again.

The Town Park District is costing taxpayers $32.8 million. Town Lighting District, $8.7 million. Town Parking District, a mere $43,000 -- no wonder you can't find a parking space!

And let's not forget the County Sewage Disposal District coming in at $39.2 mil.

Considering that all of these districts have, in one incarnation or another, their own strata of governance (be they designated as "commissioners" or otherwise), as well as their own rules of doing business (or not), the true cost to the taxpayer -- above and beyong what you see on your tax statement -- is staggering.

Do we really need a seperate Lighting District within the township, or a seperate Parking District in each unincorporated hamlet?

Over the decades, these special taxing districts have taken on lives of their own (beyond the "control" of even the governmental entities under whose name they operate and levy taxes), and, like cancer cells, have found their pervasive way into almost every aspect of our communal lives.

With limited oversight by Town, County and State, few internal constraints, and little if any effective input from the folks who foot the bills (that would be us), the special taxing districts have evolved into tax levy-sustaining fiefdoms, no longer serving the greater good, but merely perpetuating a system where the few serve themselves at the taxpayers' expense.

And so, the panels and commissions convene and opine -- all reaching similar conclusions, more or less: that most of the operations of the so-called special districts can and should be consolidated, and that many can and should be eliminated outright.

The potential savings to the taxpayers like the number of customers served by McDonalds -- billions and billions!

If only we could get past the "can and should" and reach the "are being and have been!"

Of course, there is a downside to consolidating and eliminating the special taxing districts. Imagine the hundreds if not thousands of special district workers -- those who thank the party for their patronage -- who would join the ranks of Long Island's unemployed.

Not to worry. We're confident that no show jobs with attendant six-figure salaries can be found for the disposed and the displaced at the County Seat or in Town Hall.

- - -

LI's 'special' districts draw scrutiny

By Michaek Rothfeld

michael.rothfeld@newsday.com

Nassau and Suffolk counties account for half of all revenue collected in New York State by special districts -- the small and relatively unknown government entities that operate in local towns with little oversight -- a new report by state Comptroller Thomas DiNapoli has found.

In Nassau, the $400 million collected by special districts -- for sanitation, lighting, water and other services -- represented 31 percent of the $1.3 billion statewide total in 2004, the year DiNapoli studied. The $240 million collected in Suffolk was 19 percent of the total that year.

In addition, tax-weary homeowners in Nassau paid an average of $946 for special districts, the most in the state in 2004 and more than 31/2 times the $257 average. Suffolk homeowners paid $512.

Nassau also had the distinction of being home to 15 percent of the state's garbage districts. And those 24 districts collected $181.1 million a year, 14 percent of all special district revenue in New York, the report said.

Special districts first began sprouting up around 1930 and have become more common over the last 50 years as suburban and rural areas have grown. They were put into place to provide services and bill taxpayers within small geographic areas.

But the districts, which now number 6,927, have become so ubiquitous and overlapping -- and often, secretive -- that they are coming under intense scrutiny. DiNapoli cited media reports about wasteful spending, such as a Newsday series in 2005 about spending practices in Long Island fire districts.

"While special districts give towns the flexibility they need to provide critical services to residents, they don't always operate as efficiently and equitably for all taxpayers," DiNapoli said.

In Nassau, nearly 52 percent of all town revenue is collected in special districts, adding hundreds of dollars to tax bills. In some cases, districts are independent of towns and have their own commissioners. In most cases, DiNapoli said, they are simply units of town government which collect revenue, either through property taxes or user fees, and operate on their own for a specific purpose. The cost of government has become a hot-button political issue. DiNapoli said New York has the third highest property taxes in the nation.

Gov. Eliot Spitzer has created a Commission on Local Government Efficiency to study consolidation. Nassau County Executive Thomas Suozzi is examining a potential consolidation of local taxing authorities. Suffolk County Executive Steve Levy is looking at sharing resources among school districts. And Nassau Comptroller Howard Weitzman has audited several special districts and highlighted poor accounting and spending practices.

"It is a much bigger problem here on Long Island than it is in the rest of the state," Suozzi said.

"This time next year, I'll have a solid, tangible result regarding what should be consolidated and how much money it will save."

DiNapoli, without taking a position on the issue, said the state could pass legislation requiring towns to undertake a consolidation study if, for instance, 65 percent of its population lived in an area serviced by more than one district with the same purpose.

Long Island is definitely at the epicenter of special districts in terms of revenue, but in quantity, the upstate counties of Erie, Onondaga and Monroe contain 34 percent of all state special districts, DiNapoli said. Suffolk has 200 and Nassau has 140 -- a combined 5 percent of the state total.

Copyright 2007 Newsday Inc.

- - -

Locally, Long Islanders can check out -- and become actively involved with -- a homegrown, grassroots effort to gain much needed control over the special taxing districts -- Residents for Efficient Special Districts. [Yes, a misnomer, as in, "the only efficient special district is an eliminated special district!"]

For more information on RESD, fill out and submit their online form, or send an e-mail to information@resd.info.

Tuesday, March 27, 2007

The Greening Of Suburbia's "Grayfields"

Today's "Grayfields" Are Tomorrow's "Brownfields;" Planners Look For New Ways To Keep Old Suburbs Green

The suburbs of Buffalo, New York are not unlike suburban Long Island -- sprawl, an aging infrastructure, a built-out economy, and decades of reliance upon haphazard development and rampant growth that was anything but "smart."

Now, planners, urbanisists, and the new suburbanists, are reconfiguring the vehicle-driven idea of suburbia, hoping to change that strip mall mentality into a community-centric, pedestrian-friendly state of mind.

Planners on Long Island can -- and should -- take a page from what's on the drawing board in the suburbs of Buffalo.

The rest of us can read all about it, and hope that county and local governments here on Long Island not only take notice, but call for action on the homefront, turning grayfields into greenfields before they decay into brownfields.

We can't say they have the problem licked in the suburbs of Buffalo, or that they even have a handle on it, but at least they're realizing that they've got a problem.

To us, that's the first step in the revitalization process -- realizing we have a problem.

The upstate suburbs have a long way to go, to be sure. As for Long Island's woes, until local government accepts that the decline of grayfields into brownfields cannot be halted by brick pavers and Victorian-style street lamps -- or by building municipal parking fields that lay empty, the surrounding business districts in ruins -- the very problems suburban planners probe here will persist.

- - -

Aging retail outlets present a dilemma; Developers struggle to give stores new life

Sandra Tan

News Staff Reporter

They are a suburban omnipresence: once-vibrant shopping centers and plazas that now litter the landscape.

There are big ones: Town Hall Plaza in Hamburg. Garden Village Plaza in Cheektowaga. The Lockport Mall. Sheridan-Delaware Plaza in the Town of Tonawanda, and Sheridan Plaza in Amherst.

There are small ones, built in the '50s and '60s. Their careworn storefront rows, low-rent tenants and vacancies depress the view along well-traveled streets.

These are "grayfields" -- older, underperforming retail areas surrounded by empty, faded parking lots.

By definition, grayfields are dying places, but local officials and developers are fighting to bring them back to life. Some are meeting with success, but others have a long way to go before their tired retail districts find new purpose.

"The problem the city has been dealing with for years has clearly arrived in the suburbs," said Amherst Planning Director Eric W. Gillert. "So now when we talk about we're all in this together, we're not kidding."

Buffalo has many struggling retail areas, but the phenomenon of aging strip plazas is predominantly a suburban problem.

Sheridan Drive is a perfect example.

The long retail corridor runs through Amherst and the Town of Tonawanda. And large chunks of it -- especially closer to Niagara Falls Boulevard -- are hard on the eyes.

Of roughly 20 older strip plazas that line that stretch of Sheridan, most appear outdated or run-down, and nearly half contain vacant storefronts.

"It's like a diseased mall," said Eric Recoon, vice president of leasing for Benderson Development Co.

Since Sheridan is such a heavily traveled thoroughfare, many of the plazas are at least partly occupied but often filled with low- rent tenants.

"Sheridan is a poster child for what can happen as places age," said Kate Foster, director of the University at Buffalo Regional Institute.

This retail strip is like many others scattered throughout the suburbs.

Many were built 50 years ago, following the suburban explosion after World War II. Since that time, larger and more attractive plazas and malls have robbed older plazas of their best tenants.

In addition, as big-box department stores have folded over the years -- including many on Sheridan Drive -- they've left behind giant, unusable spaces, killing surrounding retailers that relied on the anchor's traffic.

"When people think about grayfields, they're thinking about places that are becoming obsolete," Foster said.

Efforts to redevelop grayfields in Western New York have seen mixed results. Benchmark Group has seen noteworthy success, introducing a Buffalo Athletic Center for Women in the old Colvin- Eggert Plaza and building new boutique-style retail in the old Sheridan-Delaware Plaza, both in the Town of Tonawanda.

The development group also has transformed the old Clarence Mall after purchasing it from an out-of-state partnership. Now called The Shops at Main/Transit, the once-tired plaza with a former Ames and Burlington Coat Factory is once again filled with major retailers.

Benchmark even managed to retrofit the existing Burlington building, which now houses a Bed Bath and Beyond.

"We felt it was a great location, with great demographics surrounding it," said Executive Vice President Martin DelleBovi, director of development. "It just needed an influx of creative money and effort to bring it up to current times."

DelleBovi said redeveloping an old plaza is challenging because it often involves relocating or working around existing tenants. But those tenants provide the developer with revenue during renovations, and town governments happily support such projects.

"Municipalities tend to be very cooperative because they want to see that property turned around," he said. "It's a much easier sell to develop an existing piece of property than to build on vacant land."

Except when it comes to Wal-Mart.

Benderson Development has courted the nation's largest retailer to serve as the revitalizing anchor for the ailing Brierwood Plaza in Hamburg and Sheridan Plaza in Amherst. Wal-Mart also is seeking to take over the aging Lockport Mall.

Each case has met with some organized opposition, though others are eager for the retail giant to fill in the deteriorating commercial property.

Benderson has lured other major retailers as well. It recently brought in a Lowe's to Eastview

Plaza at Transit and Maple roads in Amherst and is renovating the plaza's adjacent retail space, Recoon said.

It is harder for smaller strip plaza owners to reinvent themselves.

Many are owned by limited-liability partners or even a plaza occupant; they don't have the money or credit needed for a large- scale renovation, said Linda Stang, president of Property Management Associates, which handles some distressed properties.

At the town level, promoting the renewal of tired shopping centers requires a coordinated and multifaceted approach.

This year, Amherst, the Town of Tonawanda and Cheektowaga have joined forces with Buffalo to embrace a regional strategy for combating vacant properties called "Blueprint Buffalo."

Among its four key recommendations was to find a way to redevelop grayfield spaces.

The report recommends changes in policy, incentives and zoning requirements.

Amherst, which probably has the greatest concentration of strip plazas, has taken a two-pronged approach: It has changed its zoning requirements and offered tax breaks to property owners who fix up older buildings in lagging commercial areas.

"It's still more expensive to rehab a property than to build from scratch, and that's why we're trying to level the playing field," said Colleen DiPirro, president of the Amherst Chamber of Commerce.

Parts of Eggertsville, Snyder, Harlem-Kensington and Williamsville have been designated "enhancement zones" or redevelopment zones.

The Amherst Industrial Development Agency has approved 30 projects in these zones since 2000, but only three involved retail buildings, said James Allen, executive director of the Amherst IDA. And only one involved a strip mall -- University Plaza, which received a major face-lift in 2000.

Gillert said, "We haven't had a lot of success with strip plazas, but that's because the zoning ordinance hadn't been changed."

In January, the Town Board adopted new zoning laws that make it possible for owners of older properties to redevelop them as "mixed- use" buildings that offer a mixture of retail, office and residential space and are more pedestrian friendly.

The Planning Department is still working on where the mixed-use zoning will apply.

© 2007 Buffalo News

The suburbs of Buffalo, New York are not unlike suburban Long Island -- sprawl, an aging infrastructure, a built-out economy, and decades of reliance upon haphazard development and rampant growth that was anything but "smart."

Now, planners, urbanisists, and the new suburbanists, are reconfiguring the vehicle-driven idea of suburbia, hoping to change that strip mall mentality into a community-centric, pedestrian-friendly state of mind.

Planners on Long Island can -- and should -- take a page from what's on the drawing board in the suburbs of Buffalo.

The rest of us can read all about it, and hope that county and local governments here on Long Island not only take notice, but call for action on the homefront, turning grayfields into greenfields before they decay into brownfields.

We can't say they have the problem licked in the suburbs of Buffalo, or that they even have a handle on it, but at least they're realizing that they've got a problem.

To us, that's the first step in the revitalization process -- realizing we have a problem.

The upstate suburbs have a long way to go, to be sure. As for Long Island's woes, until local government accepts that the decline of grayfields into brownfields cannot be halted by brick pavers and Victorian-style street lamps -- or by building municipal parking fields that lay empty, the surrounding business districts in ruins -- the very problems suburban planners probe here will persist.

- - -

Aging retail outlets present a dilemma; Developers struggle to give stores new life

Sandra Tan

News Staff Reporter

They are a suburban omnipresence: once-vibrant shopping centers and plazas that now litter the landscape.

There are big ones: Town Hall Plaza in Hamburg. Garden Village Plaza in Cheektowaga. The Lockport Mall. Sheridan-Delaware Plaza in the Town of Tonawanda, and Sheridan Plaza in Amherst.

There are small ones, built in the '50s and '60s. Their careworn storefront rows, low-rent tenants and vacancies depress the view along well-traveled streets.

These are "grayfields" -- older, underperforming retail areas surrounded by empty, faded parking lots.

By definition, grayfields are dying places, but local officials and developers are fighting to bring them back to life. Some are meeting with success, but others have a long way to go before their tired retail districts find new purpose.

"The problem the city has been dealing with for years has clearly arrived in the suburbs," said Amherst Planning Director Eric W. Gillert. "So now when we talk about we're all in this together, we're not kidding."

Buffalo has many struggling retail areas, but the phenomenon of aging strip plazas is predominantly a suburban problem.

Sheridan Drive is a perfect example.

The long retail corridor runs through Amherst and the Town of Tonawanda. And large chunks of it -- especially closer to Niagara Falls Boulevard -- are hard on the eyes.

Of roughly 20 older strip plazas that line that stretch of Sheridan, most appear outdated or run-down, and nearly half contain vacant storefronts.

"It's like a diseased mall," said Eric Recoon, vice president of leasing for Benderson Development Co.

Since Sheridan is such a heavily traveled thoroughfare, many of the plazas are at least partly occupied but often filled with low- rent tenants.

"Sheridan is a poster child for what can happen as places age," said Kate Foster, director of the University at Buffalo Regional Institute.

This retail strip is like many others scattered throughout the suburbs.

Many were built 50 years ago, following the suburban explosion after World War II. Since that time, larger and more attractive plazas and malls have robbed older plazas of their best tenants.

In addition, as big-box department stores have folded over the years -- including many on Sheridan Drive -- they've left behind giant, unusable spaces, killing surrounding retailers that relied on the anchor's traffic.

"When people think about grayfields, they're thinking about places that are becoming obsolete," Foster said.

Efforts to redevelop grayfields in Western New York have seen mixed results. Benchmark Group has seen noteworthy success, introducing a Buffalo Athletic Center for Women in the old Colvin- Eggert Plaza and building new boutique-style retail in the old Sheridan-Delaware Plaza, both in the Town of Tonawanda.

The development group also has transformed the old Clarence Mall after purchasing it from an out-of-state partnership. Now called The Shops at Main/Transit, the once-tired plaza with a former Ames and Burlington Coat Factory is once again filled with major retailers.

Benchmark even managed to retrofit the existing Burlington building, which now houses a Bed Bath and Beyond.

"We felt it was a great location, with great demographics surrounding it," said Executive Vice President Martin DelleBovi, director of development. "It just needed an influx of creative money and effort to bring it up to current times."

DelleBovi said redeveloping an old plaza is challenging because it often involves relocating or working around existing tenants. But those tenants provide the developer with revenue during renovations, and town governments happily support such projects.

"Municipalities tend to be very cooperative because they want to see that property turned around," he said. "It's a much easier sell to develop an existing piece of property than to build on vacant land."

Except when it comes to Wal-Mart.

Benderson Development has courted the nation's largest retailer to serve as the revitalizing anchor for the ailing Brierwood Plaza in Hamburg and Sheridan Plaza in Amherst. Wal-Mart also is seeking to take over the aging Lockport Mall.

Each case has met with some organized opposition, though others are eager for the retail giant to fill in the deteriorating commercial property.

Benderson has lured other major retailers as well. It recently brought in a Lowe's to Eastview

Plaza at Transit and Maple roads in Amherst and is renovating the plaza's adjacent retail space, Recoon said.

It is harder for smaller strip plaza owners to reinvent themselves.

Many are owned by limited-liability partners or even a plaza occupant; they don't have the money or credit needed for a large- scale renovation, said Linda Stang, president of Property Management Associates, which handles some distressed properties.

At the town level, promoting the renewal of tired shopping centers requires a coordinated and multifaceted approach.

This year, Amherst, the Town of Tonawanda and Cheektowaga have joined forces with Buffalo to embrace a regional strategy for combating vacant properties called "Blueprint Buffalo."

Among its four key recommendations was to find a way to redevelop grayfield spaces.

The report recommends changes in policy, incentives and zoning requirements.

Amherst, which probably has the greatest concentration of strip plazas, has taken a two-pronged approach: It has changed its zoning requirements and offered tax breaks to property owners who fix up older buildings in lagging commercial areas.

"It's still more expensive to rehab a property than to build from scratch, and that's why we're trying to level the playing field," said Colleen DiPirro, president of the Amherst Chamber of Commerce.

Parts of Eggertsville, Snyder, Harlem-Kensington and Williamsville have been designated "enhancement zones" or redevelopment zones.

The Amherst Industrial Development Agency has approved 30 projects in these zones since 2000, but only three involved retail buildings, said James Allen, executive director of the Amherst IDA. And only one involved a strip mall -- University Plaza, which received a major face-lift in 2000.

Gillert said, "We haven't had a lot of success with strip plazas, but that's because the zoning ordinance hadn't been changed."

In January, the Town Board adopted new zoning laws that make it possible for owners of older properties to redevelop them as "mixed- use" buildings that offer a mixture of retail, office and residential space and are more pedestrian friendly.

The Planning Department is still working on where the mixed-use zoning will apply.

© 2007 Buffalo News

Friday, March 23, 2007

More Special Taxing Districts, PLEASE!

Blue Ribbon Commission Finds Buried Blueprints

The Governor wants to put the check on the special districts -- calls for a "commission."

The County Exec says we have too many layers of local government -- calls for funding of a "blueprint."

The Nassau County Comptroller and the Nassau County Assessor both say that the hundreds of special taxing districts are bleeding Long Islanders dry. [We reached them both for comment as they were driving Alan Hevesi home in their County cars.]

A study -- you know, the kind that keeps the Long Island Index in business -- shows we pay more but get less.

We say, bolderdash!

We're going about this all wrong, folks.

There's not a darn thing wrong with special districts but for the fact that we don't have enough of them.

Yes, you heard us correctly. We need MORE SPECIAL TAXING DISTRICTS.

In fact, according to the combined Blight/Special District study commissioned by The Community Alliance, as chaired by Hempstead Town Councilman Tony "they enjoy paying more" Santino, the only practical way to solve the myriad problems created by the special districts is to create a special district for every Long Island taxpayer.

Think about it.

Can't afford health insurance or life insurance? No problem. We set up a Special "illegal basement apartment" District, "elect" you as Commissioner, and, voila, you've got lifetime coverage. [In fact, we'll even cover you after you die!]

Haven't had a vacation in years? No problem.

You are annointed Commissioner of the Special "roll the dice" District, and off you go for two weeks in Vegas?

Car troubles? No problem.

As Commissioner of the Special "we need a race car for training purposes" District [and the Special "take your county car home over the weekend" District], you'll have cars on call 24/7. [Yes, you can wear the commissioner's hat in more than one district. The more the merrier! In fact, in the Town of Hempstead, its mandatory.]

Can't afford the house you live in? No problem.

Simply send your resume -- or voter registration card, if you are a Republican -- to Hempstead Town Supervisor, Kate Murray, and you can vie for the venerable position of Building Commissioner. [No, that's not a special district, but its still good work if you can get it!]

You see, as things stand now, only the few and the connected benefit from the hundreds of special taxing districts we have on Long Island.

True, some will be benefiting while doing time at Sing Sing or Green Haven, but that's a small price to pay for a lifetime of fleecing the taxpayers.

If only each of us had a special district to call our own, complete with pension credits and the occasional steak dinner at Mortons, who would we be to complain?

Special districts. If you can't eliminate 'em or consolidate 'em, get one of your very own!

The Governor wants to put the check on the special districts -- calls for a "commission."

The County Exec says we have too many layers of local government -- calls for funding of a "blueprint."

The Nassau County Comptroller and the Nassau County Assessor both say that the hundreds of special taxing districts are bleeding Long Islanders dry. [We reached them both for comment as they were driving Alan Hevesi home in their County cars.]

A study -- you know, the kind that keeps the Long Island Index in business -- shows we pay more but get less.

We say, bolderdash!

We're going about this all wrong, folks.

There's not a darn thing wrong with special districts but for the fact that we don't have enough of them.

Yes, you heard us correctly. We need MORE SPECIAL TAXING DISTRICTS.

In fact, according to the combined Blight/Special District study commissioned by The Community Alliance, as chaired by Hempstead Town Councilman Tony "they enjoy paying more" Santino, the only practical way to solve the myriad problems created by the special districts is to create a special district for every Long Island taxpayer.

Think about it.

Can't afford health insurance or life insurance? No problem. We set up a Special "illegal basement apartment" District, "elect" you as Commissioner, and, voila, you've got lifetime coverage. [In fact, we'll even cover you after you die!]

Haven't had a vacation in years? No problem.

You are annointed Commissioner of the Special "roll the dice" District, and off you go for two weeks in Vegas?

Car troubles? No problem.

As Commissioner of the Special "we need a race car for training purposes" District [and the Special "take your county car home over the weekend" District], you'll have cars on call 24/7. [Yes, you can wear the commissioner's hat in more than one district. The more the merrier! In fact, in the Town of Hempstead, its mandatory.]

Can't afford the house you live in? No problem.

Simply send your resume -- or voter registration card, if you are a Republican -- to Hempstead Town Supervisor, Kate Murray, and you can vie for the venerable position of Building Commissioner. [No, that's not a special district, but its still good work if you can get it!]

You see, as things stand now, only the few and the connected benefit from the hundreds of special taxing districts we have on Long Island.

True, some will be benefiting while doing time at Sing Sing or Green Haven, but that's a small price to pay for a lifetime of fleecing the taxpayers.

If only each of us had a special district to call our own, complete with pension credits and the occasional steak dinner at Mortons, who would we be to complain?

Special districts. If you can't eliminate 'em or consolidate 'em, get one of your very own!

Yes Virginia, There IS Too Much Local Government On Long Island

Yet Another Study Concludes, LIers Pay More, Get Less

Surprise!

A new study, entitled A Tale of Two Suburbs, conducted by the Center for Government Research, finds that Long Islanders believe we have too much local government [Duh! Ya think?], and we aren't getting the bang for the buck that the folks in fire districts, water districts, sanitary districts (to name a few) tell us we're getting.

In fact, we're paying way too much, and getting far too little.

When the study, prepared by Long Island Index, compares Nassau and Suffolk to counties in Northern Virginia, the difference between what is paid and what taxpayers get becomes most glaring.

Nothing most of us don't already know.

Indeed, this should be the kind of report that hammers the final nails into the coffins of the hundreds of special taxing districts that have a stranglehold on Long Island's taxpayers.

Unfortunately, where we should be demanding consolidation and elimination, all we are likely to see, at least any time in the near future, are more studies, surveys, reports, commissions, and blueprints.

- - -

Study: LI getting short-end on services

By Reid J. Epstein

reid.epstein@newsday.com

The hundreds of units of local government on Long Island lead directly to higher taxes, but not better services, according to a study being released Thursday by the Long Island Index.

The study, which examined government services and attitudes toward government on Long Island and in two Northern Virginia counties, found Long Islanders pay more than 50 percent more in property taxes, yet are far less satisfied with their local public officials than people in suburban Northern Virginia.

The reason, according to the study, lies in Long Island's 439 units of local government, school districts and special districts. In Fairfax and Loudoun counties -- Washington, D.C., suburbs with about half Long Island's population -- there are 17 such districts.

"People have to stand up and say ... 'You don't get better service,'" said Charles Zettek, of the Center for Government Research, which did the study.

The two Northern Virginia counties -- Fairfax and Loudoun -- are similar to Long Island in size, cost of living and status as a commuter region adjacent to a major East Coast city. But unlike Long Island, where open space is scarce, Northern Virginia is a rapidly expanding region where new home construction continues at a rapid pace.Like Long Island, Northern Virginia is affluent and suburban. But while Long Island evolved as a hodgepodge of local governments, Fairfax and Loudoun Counties operate with centralized control of local government, schools and fire departments.