Wednesday, February 28, 2007

PERMIT Me To Introduce Myself!

Not On The Desk Of Supervisor, Kate Murray, That's For Sure. . .

When Harry Truman was President, he kept a sign on his desk that read, THE BUCK STOPS HERE -- meaning, he took responsibility for the actions of those who served in his administration.

In Japan, when there is misdoing somewhere down the corporate ladder, it is not unusual for the chief executive to give a mea culpa by means of harakiri.

Surely, there's no sign alluding to the buck stopping -- or so much as yielding -- on the desk of Town of Hempstead Supervisor Kate Murray. After all, in Hempstead Town, the buck does not stop -- it passes. To cronies, relatives, and Republican committeemen.

As for harakiri, we certainly wouldn't suggest that Ms. Murray disembowel herself [think of the mess on the carpets], but surely, a thorough house cleaning deep in the bowels of Hempstead Town Hall is in order.

It won't happen, of course.

In a Town where one hand washes the other; where "you scratch my back, I'll scratch yours;" where patronage and nepotism -- with no apparent regard for competence -- is the order of the day; where taxpayers ante up to pay health insurance premiums for dead Town employees; where there hasn't been a change in government since the Chicago Cubs last won the World Series, you just can't expect reforms to be discussed, let alone to take hold.

What Kate Murray knew or should have known -- as obvious as it is troubling-- is almost beside the point here.

Murray, as Supervisor, pushed for John Loeffel's appointment as Building Department Commissioner.

Loeffel was no entry-level employee who simply forgot to get a permit for his shed.

The ex-Commissioner reported directly to the Supervisor, and was, by extension, a part of Murray's executive team.

So why, then, did not Supervisor Murray step to the plate when this tragic story broke, firing John Loeffel, rather than allowing him to slither away by means of a faxed letter of resignation?

Who's in charge at Hempstead Town Hall, anyway? Where is the accountability, the transparency, the "I take responsibility for what happens on my watch?"

Perhaps in the myopic world of Kate Murray, the sordid misdeeds of her ex-Commissioner can simply be swept under the rug on the fourth floor of Town Hall, this by a less than contrite, "I have no control over John Loeffel."

This would logically follow the party line offered up, time and time again, in Hempstead Town Supervisor lingo, as in, "I have no control over the Town's Sanitary Districts," "I have no control over the tax rates," "I have no control over who gets what political plum of a job at Town Hall."

John Loeffel's fall from grace may be an aberration of sorts in the manner in which business is conducted in Hempstead Town. We don't think so. Everyone who has one eye open and something akin to a pulse knows that, yes, this is, as opined by one atuned civic advocate of longstanding, but "the tip of the iceberg."

- - -

HEMPSTEAD BUILDING SCANDAL

This just can't be permitted!

By Ellis Henican

Rip it down!

Return John Loeffel's super-sized Colonial to the humble one-story Cape of its origins!

No other penalty will suffice!

Isn't that what Hempstead's suddenly ex-building commissioner would have ordered you or me to do if we'd been caught installing an illegal deck or throwing up an unauthorized shed in the backyard?

Remove the offending structure at once.

So why should this mendacious municipal miscreant be treated any more leniently than the lowliest Hempstead homeowner is treated every day?

No one forced him - without benefit of permit - to turn a perfectly lovely Levittown home into Tara on Knoll Lane.

Rules are rules, as they say in the code-enforcement business. No permits, no house.

Loeffel can't exactly claim ignorance as a defense. Thirty-eight years as a Hempstead Town employee. Ten as code-enforcement officer. Since December, he's been the $112,000 man, in charge of the whole building department, responsible for ensuring that all of Hempstead's homes and businesses are in full compliance with the building code.

And this was no subtle upgrade that Loeffel lavished on himself. It was more like an episode from "Pimp My House."

The ski-slope roof. The double peaks in front. What looks like a finished attic. An illegal apartment upstairs. And all of it assessed for taxes as if it had never been improved.

It was only Monday that Newsday's Eden Laikin started asking questions about the town building boss' unapproved reno job. Supervisor Kate Murray, who happens to live just down the block and swore she was clueless about everything, had to concede that Loeffel didn't seem to have applied for any permits.

Talk about quick turnaround. Yesterday, Hempstead code enforcers and county assessors were out on Knoll Lane, inspecting the McMansion.

They tried to keep their distance from the growling backyard dog. But they found the illegal apartment and countless other violations of the building code he'd sworn to enforce. By late afternoon, Loeffel's resignation was on the fax machine.

You have to figure Nassau DA Kathleen Rice is already sniffing around at the case.

Oh, comeuppance is sweet. And the maddening questions do not stop.

Who else in the Hempstead building department knew about the boss' permitless rehab? Did all the code enforcement officers really have no idea?

What about the contractors who did the commissioner's renovation on the sly? Did they get any favors from the building department in return?

And how could Murray, who'd been praising Loeffel as a "dedicated member of the building department," have stayed so thoroughly in the dark? All the time the house was being renovated, didn't she notice that no permits were posted anywhere?

The fact of the matter is that Loeffel was just another wink-and-a-nod hack official at Hempstead Town Hall, where not too many things ever get questioned.

Dorothy Goosby was the only one to raise a stink in December when he got the job. But Goosby is the only Democrat on the otherwise-Republican Council. So her questions about the commissioner's qualification were ignored, as usual.

If you talk to people around Town Hall, they'll tell you Loeffel's a pleasant enough guy - a burly fellow with an easy manner who knows how to get along.

And maybe that's the problem here.

Longtime Hempstead civic leader Seth Bykofsky, former president of the West Hempstead Civic Association, was saying yesterday that none of this is a real surprise to him. Sometimes, people don't want to know.

"These permits are supposed to be conspicuously displayed by the contractors," Bykofsky said.

"That should have a raised a red flag in the supervisor's mind. "And wouldn't other people in the building department have to know, even if casually? Where's the inspection? Wasn't that somebody's job? Can't you hear them talking around the office: 'Is the commissioner inspecting his own property? '"

Many questions, not so many answers. Yet.

"This is the tip of the iceberg," Bykofsky said. "It's what happens when Town Hall has been under the control of the same party for more than 100 years. I don't care what party it is. If no one's watching, this is bound to happen. Now it's happened again."

Copyright 2007 Newsday Inc.

Tuesday, February 27, 2007

Town of Hempstead Building Commish Resigns

Insult to injury? First, the Building Commissioner -- now ex-Commissioner -- fails to secure required permits. Then, he makes major renovations to his house, greatly increasing the square footage. [Going from a Levittown cape to a 3-story colonial will do that to you!]

Had the work been performed with permits and within the purview of the law, the ex-Commissioner's assessment/property taxes would have gone up by about $2000.

So who knew? [Or, more aptly, among those who knew or should have known, who would say?]

Now, it is discovered that Hempstead Town's esteemed Building Commish not only flaunted the law and abused his office, he also maintained an illegal accessory apartment in his newly renovated house.

What more can we -- what more can anyone -- say?

If the commissioner of the Town department whose duty it is to enforce the building code and root out illegal apartments, himself had an illegal apartment in his own house, who is to complain about Joe Blow in Elmont or John Q. Public in Levittown maintaining an illegal apartment or two?

We have seen the enemy, and he is well entrenched -- in Hempstead Town hall!

- - -

Building chief resigns after skipping permits

By Eden Laikin

eden.laikin@newsday.com

Embattled buildings commissioner John Loeffel faxed his resignation to Hempstead Supervisor Kate Murray Tuesday, a day after it was discovered he had made renovations to his Levittown home without permits and on the same day building inspectors found an illegal apartment in the home, officials said.

Earlier Tuesday assessors were able to measure outside the home after they were originally denied entry. Building inspectors also returned and gained access to the second-floor interior, where they found the illegal apartment, town officials said.

Loeffel, who rose from deputy commissioner to the town's $112,398-a-year commissioner in December, should have paid about $2,200 more in property taxes this past year for his Knoll Lane home, said County Assessor Harvey Levinson.

After a reporter's inquiry Monday, Supervisor Kate Murray, who also lives on Knoll Lane, confirmed the town had no record of permits for the renovations or alterations and sent inspectors to the property.

By Monday afternoon, Murray, who had supported Loeffel's appointment as commissioner, asked the 38-year town employee to resign.

Loeffel, who was a code enforcement officer for 10 years before eventually taking over the building department, could not be reached for comment at his home Tuesday.

The department is charged with ensuring all town residences and businesses are up to code.

Copyright 2007 Newsday Inc.

Long Island Nation

Okay. We've been faking it at The Community Alliance blog. The REAL voice of Long Island -- albeit self-proclaimed -- is the Long Island Nation blog.

Who are we to argue?

Covering Long Island, from Elmont to Riverhead, the Long Island blog is apparently the place to post.

We're not looking for bragging rights. The bloggers at the Long Island blog are more than welcome to them. [Naming rights, on the other hand, are all ours!]

In fact, in our humble opinion, the more Long Island voices that are out there blogging, commenting, and shouting from their desktops, the better it is -- and will be -- for all of us!

So, please check out the Long Island blog. Offer comments. Take or leave the musings -- as you do ours -- for what they're worth.

The views expressed on the Long Island blog are, of course, the opinions of the bloggers. We take no credit, and offer no blame. [Geez. We have enough @&$#@! here with our own views!]

Still, Long Island is Long Island. The good, the bad, and the blogs. The more blogs and bloggers, the merrier!

Be a real -- okay, virtual -- part of your Long Island.

Leaving Long Island's School Children Behind

The good news is, Kate has already found a replacement for Loeffel, and is preparing to put the resume of one Charles Manson before the Town Board. [Shhh! Don't tell Dorothy Goosby.]

"Charles Manson is a dedicated family man," said Murray. "He will slash the building department's budget, while entering homes in the middle of the night, unannounced, to check for code violations."

Meanwhile, in other Town-related news, it was announced today that the body of Anna Nicole Smith would be returned to Nassau for burial next to her late son.

"We're delighted to have Anna Nicole back in Nassau," commented Supervisor Murray. "She will be a fine addition to our staff at Hempstead Town Hall -- I'm thinking Zoning Board here -- and I look forward to putting her, and her dead son, on the public payroll as soon as possible."

Ah, Kate. That's Nassau, in the Bahamas. Oh, Never mind. . .

When More School Aid Actually Means Less

Sure, the talk up in Albany -- particularly from the Governor -- is more school aid and less school property tax.

The reality, however, may mean LESS money for most Long Island school districts, and barely a dent in the school property tax bills for Long Island's already strapped homeowners.

The proposed increase, averaging 3% for the majority of Long Island's districts, means that most school systems will actually receive less money (in real dollars) from Albany.

While enhancing STAR continues to be all the rage in the Capital City, there is nary a word of closing the gap between what Albany gives to upstate districts (in some cases, more than 80% of their budgets), and what Long Island's districts historically receive (typically, 13% to 16%).

One would think that scrapping the antiquated, patch-work school aid formulae would be in high order. But nooooooo. Keep the disparity and inequity going, folks. Just don't tell Elmont what they're getting in Erie.

As for a reconciliation of what Long Islanders pay to Albany in income taxes versus that which comes back home in state aid (try 25 cents on the dollar), there's nothing on the table here, either.

True, we'll probably see a bigger "rebate" check in the fall -- most of which will be eaten up in the taxes you'll have to pay on that money, with the rest swallowed by increases in the school district's tax rates, this to make up the shortfall.

Supporter's of the Governor's school aid/property tax cut proposal are counting on taxpayers not to notice that, on the whole, Long Island school districts will lose out on millions of dollars (some $68 million, according to the Senate's Deputy Majority Leader, Dean Skelos) when the average relief from Albany drops from 13% to 8%.

They figure, who will notice if we leave a few children -- or a few school districts -- behind?

Our take is that even one child, or a single school district left to fend for itself (or, more likely, to prey upon the pockets unsuspecting homeowners), is one too many!

They should be talking, up in Albany, about parity, equity, and how to best replace the regressive and burdensome property tax, rather than hanging hopes on failing STARs, and, in effect, playing Robin Hood with the taxpayers.

With bellies full, financial futures secure, and enough pork to go around in the seat of government that lies on the shores of the Hudson, whether they leave our children -- or some of them -- behind may not matter much.

We have to let the power-players in Albany know, in no uncertain terms, that the future of our children matters very much to us!

- - -

This Is Not Your 1983 Governor’s School Aid Plan

By Ford Fessenden

The new Democratic governor has proposed his first budget, calling for a significant increase in education spending for New York City and similarly needy school districts. Many suburban districts would get less aid. The mayor praises the governor’s vision; suburban state senators are howling.

In this chronology, the new governor is not Eliot Spitzer. It is Mario M. Cuomo, and the year is 1983. Governor Cuomo was trying to redistribute more state education aid to needier districts, but the plan was met with fierce opposition. Suburban superintendents invaded the capitol to protest. And Republican legislators fought the plan and won: school aid around the state remained pretty much at the same level it was the year before. A lawsuit was filed to challenge the state education aid formula, and the court eventually ruled that the state had to address concerns about needier districts. Gov. George E. Pataki vigorously fought the lawsuit for 12 years.

Now, that Governor Spitzer has unveiled his ambitious proposal to increase state aid significantly for schools in New York City and other needy districts, school officials on Long Island are poring over the plan to find out what it will mean for their districts.

Across Long Island, 72 of 117 districts would get increases of 3 percent or more in the governor’s proposed budget. Nine districts, including Farmingdale, Cold Spring Harbor and Elwood, would get less than last year. Hempstead and Brentwood would see significant increases.

Mr. Spitzer’s proposal to shift dollars to poorer districts differs from Mr. Cuomo’s in crucial details: Mr. Cuomo tried to cut aid to more affluent districts, which meant that just about every suburban district would lose money. Mr. Spitzer has proposed a spending increase so huge — $7 billion in added spending over four years — that there are few losers: Some rich suburban districts will get slightly more, while poor districts get a bonanza.

Also, Governor Spitzer, intent on winning support from most Republican suburban lawmakers, promises that his proposal will be coupled with property tax relief. He has also proposed changing the aid formula so that all districts get an increase in their lump-sum state aid, known as “foundation” aid. Additional state dollars would be provided for specific categories, based on need.

“The time you really hear from the districts is when you actually cut their state aid,” said E. J. McMahon, executive director of the Empire Center for New York State Policy, a conservative fiscal policy group. “Unless the superintendents are saying, ‘This is going to have a severe impact and lead to cutting back extracurricular activities,’ the opposition might not be that strong.”

Matthew T. Crosson, president of the Long Island Association, said his group might look to limit the impact of school taxes on businesses, which could increase if costs rise but state aid doesn’t.

But beyond that, he said, “The concept of this — which is if you’re going to have additional aid it should go to the areas that need it the most, and if you’re going to have property tax relief it should go to those with the biggest burdens — it’s hard to argue with that.”

Under the governor’s plan, there would be a $1.4 billion increase in state aid, to $19.2 billion this year. An additional $1.5 billion would go to expanding the STAR tax rebate program next year, with the projection that it would grow to $6 billion in three years. The State Court of Appeals, ruling in a 13-year-old education financing case last year, said more had to be spent in New York City and other needier districts.

Every district would get at least a 3 percent increase in the basic aid program this year, and some would get much larger jumps. Depending on some smaller, targeted aid programs, a handful of districts would lose money compared with 2006-7. Over all, Long Island’s state aid would increase by 5.2 percent. In comparison, aid for New York City would increase by 9.5 percent, for Brentwood by 12.3 percent and for Hempstead by 9.6 percent.

Some school officials worry that districts that are neither rich nor poor will suffer. “I believe he gave an honest effort to get money to poor districts, but he did it at the expense of the average-need districts,” said Jim Kaden, vice president of the Nassau-Suffolk School Boards Association.

In Westchester, Lisa P. Davis, president of the Westchester-Putnam School Boards Association, said she would urge parent-teacher associations to lobby against the proposal, even though her school district, in Chappaqua, would get a 5.4 percent increase. “We want to make sure we get what we should based on all our districts’ needs,” she said.

Homeowners in every district in the suburbs would also get a substantial increase in tax rebates: an average of 23 percent on Long Island.

The Republican state senators say it ought to be more.

“Long Island traditionally gets about 13 percent of state aid,” said Tom Dunham, a spokesman for Senator Dean G. Skelos, a Republican from Rockville Centre and the deputy majority leader.

“The governor’s budget cuts our share of new aid to 8 percent. By doing that, Long Island schools are losing $68 million in money they would be entitled to under their 13 percent share.”

But the governor’s allies think there aren’t enough losers to foment a revolution this time.

“With this plan, we believe we are covering all the bases,” said Geri D. Palast, executive director of the Campaign for Fiscal Equity, the educational advocacy group that sued the state for more state aid to city schools and now supports the governor. “Nobody’s losing. Over all, the number of winners necessary to make a majority are there.”

Copyright 2007 The New York Times Company

NAILED!

What's good for the goose is supposed to be good for the gander. Apparently, this isn't the case in ye olde Town of Hempstead.

What's good for the goose is supposed to be good for the gander. Apparently, this isn't the case in ye olde Town of Hempstead.In fact, it was discovered that none other than the Commissioner of the Town's Building Department, John Loeffel -- a fixture of Hempstead Town Hall for some 38 years -- failed to apply for and obtain the necessary permits, making extensive renovations to his Levittown house, thus evading not only the law and required permit fees, but avoiding thousands of dollars in property taxes.

Loeffel -- who, coincidently, resides on the same Levittown Street as Town Supervisor Kate Murray (who, apparently, never noticed the conversion of a Levittown cape to a 3-story colonial) -- headed up a department charged with enforcing the Town's building codes.

Instead of going by the book, it would seem that Loeffel was intentionally sidestepping the rules, at the literal expense of his neighbors, who now pick up Loeffel's property tax tab.

Is it any wonder that there are so many illegal basement apartments in the Town of Hempstead -- let alone obvious building code violations that go unabated and unpunished -- when those charged with watching the hen house are themselves the wolves beating down the hen house door?

Power corrupts. And absolute power at Hempstead Town hall, as it has existed under cover of darkness in the hands of a single political party for more than 100 years, corrupts absolutely.

An aberration at the top of the Town's monolith, or a crack in the very foundation that threatens to undermine the integrity of the entire structure?

If not for the inquisitve nature of an investigative reporter, soon to be ex-Commissioner Loeffel's playing loose with the law would most certainly have gone unnoticed -- by those outside the confines of Hempstead Town hall, anyway.

"Levittown votes yes," exclaimed Town Councilman Gary Hudes when the Republican majority on the Hempstead Town board rubber-stamped Loeffel's appointment as Buildings Commish last December (Democrat Dorothy Goosby casting the lone vote in opposition). Now, Town of Hempstead residents are left to ask, "Why?"

The cleansing light of day is beginning to seep through the windows of the house Mondello built. The secret codes -- or at least the building code violations -- are being exposed. And the self-dealing, no-one-is-looking, get-away-with-everything-you-can attitudes that all too frequently corrupt a government too long in office and too short on oversight, is finally catching up to Hempstead Town.

Keep on digging, folks. Just remember to get those permits!

- - -

Failure to file his own renovations

Hempstead's building chief expands home without permits and avoids paying full taxes, officials say.

By Eden Laikin

eden.laikin@newsday.com

Hempstead Town's buildings commissioner added a second floor to his Levittown cape without the necessary permits and has been paying taxes based on an assessment for a smaller, one-story residence, according to town and county records.

John Loeffel, who rose from deputy commissioner to the town's $112,398-a-year commissioner in December, should have paid about $2,200 more in property taxes this past year for his Knoll Lane home, said County Assessor Harvey Levinson. He said an exact figure will be determined today.

After a reporter's inquiry Monday, Supervisor Kate Murray, who also lives on Knoll Lane, confirmed the town had no record of permits for the renovations or alterations and sent inspectors to the property. "Now that we know ... ," Murray's spokesman, Mike Deery, said, "the building department has issued violations."

By afternoon, Murray, who had supported Loeffel's appointment as commissioner, asked the 38-year town employee to resign. A spokesman said Loeffel had indicated he will resign.

Loeffel, who was a code enforcement officer for 10 years before eventually taking over the building department, did not return calls to his home and office seeking comment. The department is charged with ensuring all town residences and businesses are up to code.

Monday, building inspectors served Loeffel, 58, at his home with two notices of violations. One was for "construction/alterations without a permit" and the other was for plumbing work in the new upper floor without a permit, town officials said.

It's unclear when Loeffel turned the one-story cape into a two-story Colonial. However, a February 2001 picture of the former structure is still shown on the county assessor's Web site.

Yet an aerial view of the property shows the renovated home has three stories. A source said the top floor was an attic, used for storage.

"This is really awful," Levinson said. "I presumed ... there was a logical explanation for this, that a building commissioner would never take this chance. But I think we should learn from this example and impose a penalty for people who make significant improvements to homes where the value increases substantially in market value without getting permits."

Anecdotally, Levinson added, unpermitted renovations in Levittown and East Meadow are widespread. He estimated that as much 15 percent of the homes in Levittown that require permits do not have them.

In 2006-2007, there were 1,114 permits issued in Levittown for both commercial and residential alterations or improvements, assessor's records show.

"Every time you build without a permit, it results in a higher tax rate," Levinson said. "He is paying less property taxes than he should and everybody in Levittown is paying more in school taxes."

Loeffel's house is taxed on an assessed value of $346,000. Loeffel pays $7,496.54 in property taxes a year, including $4,964.72 in school taxes and $2,531.82 in town taxes.A Republican town committeeman, Loeffel began working for the town in 1969 in the public safety department before moving to the building department in 1988, records show.

When he was appointed to head the department, Murray praised Loeffel, calling him a "dedicated member of the building department."

Copyright 2007 Newsday Inc.

Monday, February 26, 2007

Them's Fighting Words!

The blogger known only as Orthomom may not be Superwoman, but in the realm of the blogosphere -- where free speech and open expression of opinion is sacrosanct -- the anonymous blogger has become something of a hero.

No, we may not agree with much of what certain religious zealots post on Orthomom's blog -- or even with the labeling of the School Board Trustee (Pamela Greenbaum of Lawrence), with whom they obviously disagree, as a "bigot" and an "anti-semite" -- but we will defend to the last anyone's right of free speech, on the Internet and otherwise, especially as concerns opinions expressed vis-a-vis a public official.

Whether or not the words written on Orthomom's blog -- either by Orthomom or one of the many (mostly Orthodox) anonymous posters -- are libelous in nature, even a first year law student knows that derogatory and possibly erroneous statements aimed at a public official are not actionable without a showing of "actual malice." [We suppose that the School Board Trustee's attorney was absent from class the day New York Times vs. Sullivan was discussed!]

We can understand Pamela Greenbaum's frustration with the majority of the Lawrence School Board-- a majority that has the best interests of private school parents at heart, not public school students, or the community at large, for that matter -- and certainly Ms. Greenbaum has every right to be upset (we think "horrified" is too strong a word) when members of the Orthodox community, who rarely see beyond their own, parochial self-interests, call her a bigot and an anti-semite (statements of opinion, not fact), but clearly, there is no cause for bringing a defamation suit here, and surely, no action at law -- at least not one that could conceivably pass muster.

Pamela Greenbaum, as a staunch supporter of public education (though, in our opinion, a less than stellar representative of the cause) -- even in the face of apparent tyranny at the hands of the private school majority -- deserves praise for standing up for the public school children of Lawrence. They deserve better than what both the School Board and the voters are giving them.

To go on record saying that public funds should not be used for private schools -- a position with which we at The Community Alliance blog wholeheartedly agree -- doesn't make Ms. Greenbaum either a bigot or an anti-semite, protests by some of the more closed-minded in the Orthodox community notwithstanding.

That said, on the issue of Ms. Greenbaum's defamation suit -- designed to have a chilling effect upon free speech and public comment -- the Trustee is way off base.

Her lawsuit is nothing short of frivilous (something her attorney knew or should have known), and warrants not only outright dismissal by the trial court, but moreover, the imposition of monetary sanctions against both Greenbaum and her attorney.

Public debate and the fostering of open communications -- particularly in the forum of public education -- is not only useful, but absolutely necessary. Though unfortunate that some would stoop to name-calling and ad hominem attacks, those in the public's line of fire (as is Trustee Greenbaum), must learn to either take the heat or stay out of the kitchen.

- - -

From the Nassau Herald

Lawrence school board member Pamela Greenbaum is taking legal action to identify the person behind the Orthomom Internet blog site, which she claims carried comments calling her a "bigot" and an "anti-Semite."

By Andrew Coen

Greenbaum filed court papers on Feb. 13 against Google Inc., which owns the Orthomom blog, in Manhattan Supreme Court to force Google to reveal the blogger's identity. The petition for pre-lawsuit discovery also seeks to identify anonymous contributors to the blog who allegedly posted comments accusing the District 15 school board trustee of anti-Semitism.

In the court papers, Greenbaum said she was "horrified" to discover the comments made about her on the site by Orthomom, who invited responses to what was written.

Orthomom aims to appeal to the Long Island Orthodox Jewish community, and claims it draws more than 300,000 visitors a year. The action is a prelude to a defamation lawsuit, if the identity of the bloggers is revealed. "Every day that the defamatory material remains on the Internet for all to see, I continue to be harmed as more such material is posted," Greenbaum stated in the court papers. "I believe that I have a valid claim against the anonymous writers who are responsible for spreading these unfair lies, but without the requested information there is no way for me to find out who is responsible and to bring a lawsuit."

The attacks against Greenbaum have intensified recently, since she publicly opposed "using public funds for private-school interests."

Hofstra University Law Professor Eric M. Freedman said Greenbaum's action of seeking Orthomom's identify has little to no chance of moving forward since derogatory language against a public official like a school board member is protected under the first amendment. Professor Freedman, an expert on the First Amendment and other civil liberty issues, said in order to seek the identity to pursue a lawsuit there needs to be a chance that the grievance would be successful which is not the case in Greenbaum's action.

"If the courts are behaving appropriately this filing will go absolutely nowhere," said Professor Freedman. "If she knew who Orthomom was and sued her directly it would be thrown out."

Greenbaum was first elected to the school board in 2003, and has been a staunch supporter of preserving public-school interests in District 15. When district voters elected private-school candidates Michael Hatten and Uri Kaufman last May, for the first time the school board had a majority of non-public-school parents -- with Greenbaum the most vocal of the trustees in the minority.

Greenbaum said that her attorneys have advised her not to comment further on the suit. The law firm handling the case, Feder and Rodney, Esq., also declined comment.

In addition to seeking the identity of Orthomom, Greenbaum is also requesting a temporary restraining order preventing the blogger from adjusting or altering records and comments on the site, so that the evidence is "properly preserved."

"I think she's absolutely justified," Stanley Kopilow, Greenbaum's fellow school board member, said of her suit. "You can't slander people and stomp on people's reputation anonymously."

In a Feb. 16 blog, the anonymous Orthomom called Greenbaum's court action "frivolous" and added that if she was so offended by the comments, she could have asked to have them removed, which has been done in response to other requests in the past. "I have it on expert legal opinion that this case is a joke," wrote the blogger. "This is more about 'unmasking' me than about her hurt feelings."

Lawrence school board President Dr. Asher Mansdorf said that since 2001, when he began serving as a trustee, he has often been deeply offended by comments made about him and has even been the target of death threats, but, he added, bringing a lawsuit is not the answer to the problem. Mansdorf criticized Greenbaum's action against Google. He also slammed recent suits brought against the Lawrence school district, including one attempting to remove three Orthodox members from the board and another trying to block a referendum that, if approved, would have provided busing to pre-kindergarten students in private schools and permitted community groups the free use of school buildings after hours. Mansdorf said the court actions were "designed to intimidate."

He also expressed his concern that the impact could dampen open dialogue. "Does Pam not think that a lawsuit will have a chilling effect on free speech?" Mansdorf asked.

A spokesman for Google Inc. would only say that the company has not been served with a complaint yet in regard to Greenbaum's action.

Comments about this story? ACoen@liherald.com or (516) 569-4000 ext. 210.

Friday, February 23, 2007

An End To Sectarian Violence

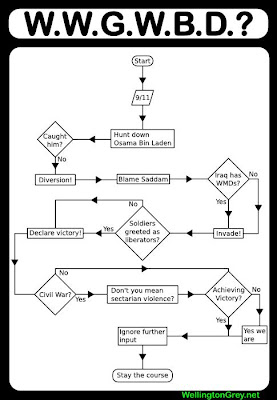

Standing in the White House rose garden, wearing a crown of thorns, President George W. Bush announced today an end to the sectarian violence in Iraq.

Standing in the White House rose garden, wearing a crown of thorns, President George W. Bush announced today an end to the sectarian violence in Iraq."There will be no more sectarian violence," the president told the press corps, assuringly. "After all," said Bush, "Iraq is a Democracy. They have a new constitution and a democratic form of government. There has to be a seperation of church and state."

Straining himself to think for a moment, the president concluded, "From this day forward, there will only be non-sectarian violence in Iraq."

MISSION ACCOMPLISHED!

Actually, we're not here to talk about sectarian violence, Bush banter, or the misery in Iraq. We could talk about that until we're blue in the face and those who don't get it won't get it.

What we are here to discuss is your participation in the day-to-day of community; the raising of individual and collective voices on issues from property taxes to school funding, affordable housing to the shenagigans of the special taxing districts.

You see, if we -- that's all of us, folks -- don't get up off our posteriors, question the status quo, roll up our sleeves, and begin to rant and rail in the public arena, then all we'll accomplish is to stay the course.

And you know where staying the course gets us. Nowhere. Or worse, Iraq.

Here at The Community Alliance blog, we offer you not only daily affirmations of community -- the good, the bad, and the downright ugly -- but more than this, the opportunity to think about the issues, to question the way local, state and federal government conduct our business and spends our money, and to speak out on the issues that impact upon your wallets, your childrens' education, your neighborhood, and your future.

We offer you the opportunity not merely to share our views, as brilliant and profound as they may be, but, through publication of Guest blogs and reader comments, the opportunity to posit and post your own thoughts, ideas, and ruminations.

Our objective in writing this blog, as often expressed here, is to get you -- that's all of you -- to question, to think, and, dare we ask, to suggest.

Mission accomplished?

Not nearly.

For the most part, the masses -- and we count you among them -- continue to be docile, timid observers of community, and not the outspoken, in-your-face, take-no-prisoners participants that community needs to survive and endure.

You are, to a lesser or greater extent, the potted plants, so deeply rooted in what was and what is, that you have all but lost the mobility required of you to put one front in front of the other, shaking off the dirt to advance into what could be.

Silence, dear friends, is acquiescence. It is acceptance of today's mediocrity; a nod to failed policies and protocol; a collective resignation that we can do no better, so why bother to try.

Nonsense!

Today, we empower you -- that's all of YOU -- to take a deep breath, get off your kiesters, brush the cobwebs away, and take a giant step forward for community.

Surely, you have an opinion or two on the issues we've been been so rancorous about in these many blogposts. Perhaps you even have a few issues of your own.

Don't hold back. Speak your minds here. Question, think, suggest, Guest blog. Be a part of the process that finds tomorrow's answers, and not a part of the "deer-in-the-headlights" crowd that addresses today's problems by remaining frozen in the tired, old stagnation of yesterday.

Write us at GuestBlog with your wit, witicism, and even unwitting thoughts.

Take the initiative -- or create one. It is, after all, YOUR community that's on the line!

Wednesday, February 21, 2007

When Fire Districts Hose The Public

Commissioners in cashmere suits -- bought at the taxpayers' expense. Lavish spending sprees. Exotic vacations. Firehouse pub rooms. And a race car next to the ladder truck.

Lack of public oversight, training, accountability, and control all cited as leading to abuses at local firehouses across the State, particularly among Commissioners, who, out of the public eye, spend our money as if it was not only their own, but flowed in abundance out of the fire hydrants.

Now, Tom DiNapoli, the freshly minted State Comptroller, wants to institute new procedures, including mandatory training for Commissioners, to stem abusive fiscal practices.

Newsday reports on the controls the Comptroller seeks to put in place.

Good ideas from Mr. DiNapoli, who has hit State Street running, at least on this issue.

A few questions, though.

Why give Commissioners 270 days after taking office to complete mandatory training courses? The rule should be that Commissioners must complete training either before they assume office, or within, say, 60 days. Let's not give them almost a year to figure out how to do it wrong before we train them how to do it right.

Will all the training in the world keep the unscrupulous Commish from abusing the public trust? The answer to this one is clearly "no." You cannot impose morals any more than you can legislate morality.

That said, with independent oversight, constant review, and established rules in place, no errant Commish, caught with hand in cookie jar, can be heard to complain, "I didn't know that I couldn't do that!"

Lastly, why is it that we, as residents and taxpayers, haven't demonstrated more outrage -- or at least outward concern -- over the fiscal abuses of our Fire Districts, Water Districts, and, dare we say, Sanitation Districts?

We didn't realize that there was an accepted level of tolerance for fleecing the public.

Our thanks to Tom DiNapoli for picking up the hose and trying to extinguish the fires.

- - -

Click HERE to see the proposed rules and to offer comment.

---

Putting out the fire

New comptroller's first oversight proposal targets fire districts, requires extended training, budget review

By Deborah S. Morris

deborah.morris@newsday.com

New State Comptroller Thomas DiNapoli yesterday made an issue of sweeping significance on Long Island - the conduct of fire districts and fire companies - the subject of his first major oversight proposals.

The former Nassau County assemblyman, tapped recently by state lawmakers for the new job, credited earlier work by his office in proposing new regulations setting training requirements for fire district commissioners.

"It certainly is an important issue and one that this office has been working on for a period of time," DiNapoli said yesterday, also citing work by Assemb. Robert Sweeney (D-Lindenhurst) to pass fire district oversight legislation last summer. "We didn't want to hold up an important initiative any longer. This will really help local officials to do the job the right way with integrity and expertise."

Doug Muzzio, a professor of public affairs at Baruch College, noted that DiNapoli, who was tapped for the job over the objections of Gov. Eliot Spitzer, picked an issue that has had its fair share of news coverage.

"Clearly one would have expected, considering the controversy surrounding him when he got the job, that he would have come up with something more to establish his name, not something that had been done already," Muzzio said. "But it's a small step. He knows he has four years to get established."

DiNapoli's regulations would require that within 270 days of taking office, all fire district commissioners get at least six hours of training in such issues as fire district management, travel procedures and policies, internal controls, fraud and abuse detection, conflicts of interest and ethics.

Districts would be required to hold annual budget hearings, adopt a code of ethics and comply with new requirements for establishing capital reserve funds and for paying travel expenses for district personnel.

"The training requirement will fundamentally reform how these entities operate and will ensure better management of public funds," DiNapoli said.

"Besides the auditing function, this office also wants to play a role as a guide dog, so they can do right by the taxpayers."

Giovanni Graceffa, chairman of the Syosset fire commissioners board, said the new training schedule will serve as protection in the long run.

"There's got to be some kind of understanding, a standard, where we are held accountable," Graceffa said. "

At the end of the day after training I can't use the line, 'I didn't know.' If the state thinks we need more training, we are behind them 100 percent." The particulars of the training still must be worked out. The public will have 45 days to comment on the proposed regulations, state officials said.

Although for years commissioners have been trained through seminars and conferences, the proposed regulations are more structured.

"We all have to be held accountable for our actions with what we do within our fire districts," said Billy Theis, a Terryville commissioner. "Fire commissioners work very hard for their districts and more training would be a benefit."

Charles Smith, a commissioner in Bay Shore, said he welcomes the training, but that everything must be spelled out.

"The state needs to be more specific in their laws and guidelines of what they expect of us," he said. "If you give it to two lawyers, each reads it a different way. That's not right."

OUT OF COMFORT ZONE

State Comptroller Thomas DiNapoli said yesterday past audits by the comptroller's office uncovered "troubling details... regarding unchecked spending."Among expenditures uncovered by Newsday in the past are deluxe hotel accommodations at conferences, extravagant recreation rooms in firehouses, race cars, hand-tailored cashmere suits and custom shirts, and non-itemized meal expenses.

Extinguishing financial excess

Regulations proposed by State Comptroller Thomas P. DiNapoli to strengthen oversight of fire districts and fire companies in New York State call for:

All fire district commissioners must get at least six hours of training on their responsibilities within 270 days of taking office.

Training course content must include information on fire district management, travel procedures and policies, procurement and disposition of fire district assets, internal controls, detection of fraud and abuse, conflicts of interest and ethics.

Fire districts must hold annual budget hearings, adopt a code of ethics, and comply with new requirements for establishing capital reserve funds and for paying travel expenses.

Fire districts with revenue of more than $200,000 also will be required to obtain an annual independent audit through a competitive process and limit the audit contract to five years.

The Office of the State Comptroller will host a live teleconference on March 8 on understanding the new requirements. The training runs from 6:30 p.m. to 8:45 p.m.

Copyright 2007 Newsday Inc.

Tuesday, February 20, 2007

It Takes A Village To Raise A Community

Stroll down Bedford Avenue in Bellmore, and you get a very real sense of what a village should look like, feel like, and be like.

Stroll down Bedford Avenue in Bellmore, and you get a very real sense of what a village should look like, feel like, and be like.From its quaint, homey shops to its varied restaurants and its multiplex cinema (that still has the look of an old-fashioned movie theatre), to the mega-depot-defying mom and pop hardware store [yes, hardware stores do still exist], there is a vibrancy, a resiliance, an intimacy that those of us in the township's unincorporated areas can only aspire to.

For the moment, its more like envy.

If Bedford Avenue looks more like Bellmore's answer to Disney's Main Street than it does the business district of your hometown, there may very good reason.

An active, strident, and always on the move Chamber of Commerce and Merchants' Association have led the way to Bedford Avenue's renaissance.

Being well-connected -- as in former Chamber President Gary Hudes, a GOP stalwart, is now a Town of Hempstead Councilman as well as a business owner (Gennaro Jewelers) -- didn't hurt, either!

The Town did its usual Victorian-style lamppost, brick paver shtick -- giving its all to reward its own -- but the bulk of the kudos belong to the local merchants who realized that a vital and vibrant community has at its core a thriving, attractive, walkable business district -- one that itself is a destination.

We would encourage anyone who would enjoy that old-time downtown "this is community" feel to stroll -- yes, you can actually stroll -- down Bedford Avenue.

Grab a bite at the Bedford Avenue Deli, International Delight Cafe, or one of nearly a dozen eateries. Catch a flick at the Bellemore Playhouse. Stop and smell the roses at one of several floral shops or to lick the ices at Ralph's or City Sweets & Desserts.

Visit Bedford Avenue in Bellmore and remember what it was like to have a real downtown, a true Main Street, in your community.

Then, go home, drive over (because, in all likelihood, you can't walk) to what passes as your town's Main Street, park the car (if you can find a space), and take a walk (we dare not call it a "stroll," as this implies a rather pleasant experience). Look around. Let us know what you see and how you feel. [If "depressed" comes to mind, take a ticket, get on line, and join the club!]

Is your Main Street more akin to Tremont Avenue in the Bronx than Bedford Avenue in Bellmore? If so, ask yourself "Why?"

Want your downtown business district to be the next Bedford Avenue? Call, write, or send smoke signals to your local Chamber of Commerce, civic association, and elected officials, from Town Councilmember on up, and ask them, "Why not?"

Friday, February 16, 2007

Republicans From LI's Senate Delegation Take Issue With Spitzer Budget

It may not be often that we agree with Long Island's Republican delegation to the New York State Senate (gee, do you think newly-elected State Senator, Craig Johnson, has anyone to carpool with?), but on matters such as property tax relief and State Aid to Long Island's school districts -- both issues of great concern to LIers -- we have to say that the Governor's budget proposals are, to say the least, troubling.

Of course, we continue to disagree with the delegation's contention that the STAR program saved Long Island homeowners over $700 million last year, and that a "play it again, Sam" vis-a-vis those property tax "Rebate" checks is a good thing.

While the Spitzer proposals may be flawed, clearly, the GOP Senators from Long Island have not articulated (can we still say that?) anything other than what amounts to staying the course -- a course which screams, "Iceberg, dead ahead" for Long Island homeowners.

The solution does not lie, as most of us have understood for a long, long time, either in enhancing STAR or in issuing rebates. Rather, a complete revamp of the property tax structure, as well as how we finance our education system, is in order.

Throwing money at a problem is rarely the answer. [Of course, we'll take as much as we can get our hands on here on Long Island.] Throwing good money after bad -- as in picking one pocket to put pork in the other -- only makes matters worse.

At least Governor Spitzer recognizes that property taxes and school aid are two issues that not only have to be addressed this year, but that the two are not mutually exclusive. At least he is willing to take the first steps in evaluating the situation, which debate -- via think tank and public expression -- will, hopefully, lead to viable, practical solutions.

The Republicans in the State Senate -- and their Democratic counterparts in the equally static Assembly -- have had how many years to come up with a plan to equalize aid to school districts and offer homeowners real property tax relief? Ten? Fifteen? Twenty? We've lost count, already.

From the looks of it, its more STAR, more rebates, more attempts to fix that broken wheel on an over-burdened wagon. The old Band-Aid approach.

We have some fresh faces in Albany -- one of them in the Governor's mansion.

Now all we need are some fresh ideas on how to deal with some very sticky -- and extremely costly -- age-old problems.

Excelsior!

- - -

LONG ISLAND SENATE DELEGATION: GOVERNOR SPITZER'S BUDGET BAD FOR NASSAU AND SUFFOLK PROPERTY TAXPAYERS

Long Island’s State Senate Delegation today (February 3) held a press conference with a Mineola family to discuss the negative impact of Governor Spitzer’s Executive Budget on local property taxpayers. The Governor’s proposed budget shortchanges Long Island schools by $68 million and raises property taxes for hundreds of thousands of Nassau and Suffolk County homeowners.

Last year, Long Island homeowners saved over $700 million through the School Property Tax Relief ("STAR") program and received $210 million in school tax rebate checks from the state. The Governor’s Executive Budget eliminates the rebate check program that benefited every homeowner and excludes families with household incomes of $80,001, or more, from fully benefiting from his property tax relief plan.

Currently, Long Island’s median household income exceeds this unfair threshold and the Governor’s plan will raise property taxes for nearly 200,000 homeowners in Nassau and Suffolk counties. In comparison, the Long Island Senate Delegation’s plan provides two and half times the new property tax relief included in the Governor’s budget proposal ($2 billion vs. $800 million), quadruples the state rebate checks and helps every homeowner.

In addition, the Governor’s Executive Budget reduces the share of total state school aid received by schools in Nassau and Suffolk counties. Traditionally, Long Island’s schools have received 13% of all state school aid. The Governor’s proposed budget reduces Long Island’s share of new state aid to 8%. As compared to the amount they would have received under their traditional 13% share, the Executive Budget shortchanges Nassau and Suffolk school districts by $68 million. Through the Governor’s proposed budget, the Mineola School District would experience a 1.04% reduction in total state aid from last year’s State Budget.In comparison, the Executive Budget raises New York City’s share of new state school aid from 38% to 46%. Because of this shift from Long Island to New York City, school districts in Nassau and Suffolk counties will receive an average state aid increase of 5%, while New York City’s schools will receive nearly 10% more state aid than last year.

Senator Dean Skelos (R-Rockville Centre) said, "The Governor’s budget is simply a bad deal for Long Island. It steals $68 million dollars from our schools and it raises property taxes for hundreds of thousands of Long Island homeowners. Long Islanders need property tax relief and the Governor has delivered nothing but empty promises. Our delegation will stand up for Long Island taxpayers and fight for the school aid property tax relief we deserve."

Senator Owen Johnson (R-West Babylon) said, "The Governor’s plan leaves too many middle-class Long Island families out in the cold with little or no meaningful property tax relief. The Senate’s property tax relief plan would quadruple the STAR property tax rebate checks for every homeowner. I will work to ensure that Long Island homeowners get the property tax relief they deserve."

Senator Kenneth LaValle (R-Port Jefferson) said, "The Governor’s school aid proposal focuses heavily on urban areas and does not adequately address the needs of suburban and rural communities. Under his school aid plan, the $1.4 billion increase in state aid is not distributed equitably and falls far short of what Long Island needs to provide a quality education at a price that taxpayers can afford."

Senator Caesar Trunzo (R-Brentwood) said, "My number one priority will be to continue providing property tax relief to Long Island's hard working families and senior citizens. The Senate has proposed over $2 billion in new property tax relief initiatives and my colleagues and I in the Long Island Senate Delegation will fight to reduce the high cost of living in the communities we represent."

Senator Kemp Hannon (R-Garden City) said, "The Governor’s school aid plan deprives Long Island’s hardworking taxpayers and their children of $68 million they deserve. Stripping away the rebate checks and giving Long Island’s share of the taxpayer’s money over to New York City’s schools is not just. Our property tax plan saves more money for more people than the Governor’s proposal."

Senator Carl Marcellino (R-Syosset) said, "We are at a crossroads. We simply cannot continue to foot the bill for the rest of the state. Enough is enough. Either we join together and stand up for our cities, towns and villages from Montauk to Valley Stream or watch as the Governor’s proposed state budget erodes our quality of life. My mind is made up. I'm fighting for Long Island."Senator Charles J. Fuschillo, Jr. (R-Merrick) said, "My number one priority remains delivering property tax relief to Long Islanders. We have proposed a plan that would put hundreds of dollars in tax savings into the hands of Long Island families by quadrupling the size of last year’s rebate program. This enhanced rebate would be addition to their STAR program savings. The Governor’s proposed budget has eliminated the much needed property tax rebate plan and cut Long Island's educational aid share to 8% of his proposed educational aid funding for the state. These cuts are unacceptable and we will continue to fight to ensure that Long Island residents receive the property tax relief they deserve."

Senator John Flanagan (R-East Northport) said, "The days of pitting the so-called rich Long Island homeowners against the rest of the state are over and this administration must work with us to provide a budget that respects that fact. The quality of Long Island education is high because our parents support their schools and they should not be asked to shoulder any more of the burden. By submitting a plan that reduces many Long Islanders’ access to much needed tax relief and provides the bare minimum to our students, Governor Spitzer is taking a poor first-step in this process and it is one that we will not accept."

- - -

The Democratic Response -- Well, Sort Of

We really don't see any answers in here, either, do you?

Senate Democrats Target Tax Relief to Those Who Need it Most Amendments would first help struggling seniors and working families

Senate Democrats unveiled two amendments to the Republican property tax rebate plan (S.1-A) scheduled to be debated and voted on today. The amendments would better target tax relief to those who need it most – primarily senior citizens and middle class working families who have been hit hardest by skyrocketing property taxes.

Both the Governor and Senate have proposed cutting property taxes by about $6 billion in an effort to reduce the overall tax burden in New York State – which is the highest in the nation.

"We have had a property tax crisis in New York State for far too long," said Senate Democratic Leader Malcolm A. Smith (D-Queens). "But under the leadership of Governor Eliot Spitzer, and with the support of this Senate Democratic Conference, we will soon see real reform of our property tax system that will bring significant and long term tax relief to our State."

The proposals we've seen are good starting points," Smith said. "Our amendments will strengthen the Senate plan and help make our property tax system more equitable while also targeting immediate relief directly to seniors and middle class New Yorkers who need help now."

Senator William Stachowski (D-Buffalo), ranking Democrat on the Senate Finance Committee, said Senate Democrats are seeking long-term solutions to the State's tax crisis. "The STAR program is a good one,but, in its present form, it does not take a homeowner's income and regional economic differences into consideration. The more we rely on STAR without addressing the structural inequities in our property tax system, the more we exaggerate those inequities."

State Senators Andrea Stewart-Cousins (D-Yonkers) and David Valesky (D-Oneida) will offer amendments, which, if enacted, would address at least some of the inequities in the State's property tax system.

Valesky's amendment to expand the Real Property Tax Credit for seniors is designed to overcome the regressive nature of property taxes by increasing the maximum credit amount for senior citizens from $375 to $1,125, and increasing the maximum credit amount for all others from $75 to $225.

The current Real Property Tax Credit limits have been ineffective in New York because they operate at a modest level and because the amounts of the credit have not been increased in 30 years. The Democratic proposal would greatly expand the program for seniors.

Valesky said, "Low and Middle income New Yorkers, particularly senior citizens living on fixed incomes, have been overwhelmed by skyrocketing Medicaid costs and other unfunded mandates that have lead to double-digit local property tax hikes."

Valesky said his amendment "would target additional relief to the people who have borne the brunt of the growing property tax burden over the last decade, in this case, New York's senior citizens."

Stewart-Cousins will offer an amendment to expand the personal income tax credit, currently allowed only to New York City renters, to the entire state. This would provide immediate tax relief to renters in suburban areas like Westchester County and Long Island, where property tax hikes have dramatically driven up rental costs.

Last year, the State increased the STAR credit for renters living in New York City, raising the refundable credit from $125 to $230 for married couples and $62.50 to $115 for all others. Stewart-Cousins said, "It is only fair that all tenants in our State receive the same Personal Income Tax credit provided to New York City renters. Many of our suburban communities are among the highest taxed in the nation, and this amendment would bring immediate relief to the tenants in those communities."

Stachowski said the Senate Democrats have discussed a number of other tax relief strategies, including "shortening the phase-in period for seniors and working families who most need immediate relief.

"We intend to be fully engaged in tax relief negotiations with the Governor and our colleagues in the Senate and Assembly, and we will bring a number of proposals to the table. We believe, as does the Governor, that a tax relief plan must promote equity and fiscal responsibility and must address the root causes of high property taxes – economic decline, irresponsible government spending, waste and debt," Stachowski said.

- - -

State Senator Craig Johnson has yet to check in on these issues of grand import to Long Islanders. If and when he does, we'll be sure to let you know.

Thursday, February 15, 2007

Public Money. Public Schools. Period!

A tax credit to parents who send their children to private and parochial schools has been proposed by Governor Eliot Spitzer as part of the Executive Budget. That would be $1,000 per child, with income limitations.

Call it a tax credit or an outright voucher, what it amounts to is public tax money being siphoned away from our public schools to pay for a private education.

I have a friend who lives in Oceanside. While he holds a valid driver's license (or so he told me, the last time he borrowed my car), he seldom drives, and never takes public transportation, opting instead to dole out untold sums to private car services to transport him hither and thither.

Someone else I am acquainted with belongs to a very posh private country club, one with beach rights during the summer. [I rarely get invited, and, after this blogpost, I surely won't.] This fella grumbles, constantly, that he not only pays thousands of dollars every year to maintain his private country club membership -- not to mention what he has to tip the cabana boy -- but he has to pay property taxes for the care, maintenance and operation of public parks which, by choice, he does not frequent.

How about a tax credit for my buddy in Oceanside who rarely uses the public roadways and never steps foot on a public bus? After all, why should he subsidize mass transit through property taxes when he does not benefit from it?

As it stands, the poor fella has to not only pay for us to use the bridges and buses, but for his ride in that private town car as well.

And that guy sipping the pina coladas on the sand adjoining that private beach club -- why should he pay taxes for state, county and town parks that he sees no benefit from, while having to dip into his own pocket yet again for those egregious private country club dues? Maybe he should get a tax credit, too.

I've never been to the Statue of Liberty, or out west to our National Parks. I prefer to visit private museums and closed-to-the-public sanctuaries, to which I donate readily. I should get a tax credit for that, don't you think?

Of course, education is different than parks, museums and public transportation.

We don't have to frolic in the parks or take a trip on Long Island Bus, after all, but every child must have an education.

And our State Constitution provides -- mandates (if not funds) -- that our children be afforded "free common schools," so why shouldn't parents (who pay taxes for public schools they don't use -- as if text books, computers, nurses, pyschologists, and bus transport constitute "non-use") get a tax break when they send their kids to private school?

Well, they shouldn't, and much for the same reasons that my buddy who prefers bicycles to buses shouldn't get a tax credit to pay for limosine service, and the guy who chooses the beach club over Eisenhower Park shouldn't get cash back from the State to help defray the astronomical cost of membership in his private haven.

In a society, we all share common obligations. We pay to run the trains and buses, even if we've never fed a fare box. We are taxed to maintain roads, bridges and tunnels -- not to mention public transit systems hundreds of miles away from where we live -- even though we may not drive, take the train, or cross that bridge in Rochester. And we are taxed, handsomely, to maintain our public parks, even when they are not maintained, and where we choose not to enjoy their benefits.

So, too, it is with public education. Perhaps, in providing for those schools, the reasons for our public support -- financial and otherwise -- are even more compelling.

You see, the very fabric of our society is woven through the education of generation next; our very future in the tiny hands of those little children we place on the school bus every morning. And it is public education that has, and, if we are going to prosper as a nation, must, going forward, serve as the firm foundation for the pillars of society that rise from ideas and ideals nurtured by well-nourished minds.

To take away funding from our public schools by tax credit, voucher, or other device, is to diminish the capacity of our children to build that better world we envision. In very real terms, it diminishes every one of us.

The State -- and the taxpayers -- do provide a system of common schools to which every child, regardless of race, creed, color, religion, sexual orientation, or even legality of residence, is invited to learn, to grow, to develop into a productive member of our community, and our society.

We call these common schools, "public schools."

"Hey, but I choose to send my child to private school, where I pay $15,000 or more a year in tuition on top of the school property tax. Its not fair!"

You are correct. Its not fair.

Its not fair that my friend has to pay taxes for a fleet of buses he never uses, and has to dig deeper into his own pocket to hire a private car service.

Its not fair that the luxury of a private country club, with its high price tag for admission, isn't subsidized by the State, especially when that pal of mine couldn't find a public park if you gave him a map.

And it is surely not fair to parents who choose -- the key word, "choose" -- to send their children to private and parochial schools to have to pay ten, twenty, and, in some cases, thirty thousand dollars a year in addition to the school property tax.

Then again, that's their choice. Fairness, equity, and your out of pocket cost going out the window.

Bottom line: Its not fair to the taxpayer to take public money -- millions of dollars of it -- from coffers that could help feed our public schools, to, in effect, subsidize private (let alone parochial) schools.

Taxes are outrageous! Agreed. We all need property tax relief, but not on the backs of our public school children.

Can't afford the Lincoln Town car to take you to the mall? Hop on a public bus.

Complain about the price of membership at your private country club (and the food hasn't been too good of late, either)? Have a picnic at a public park.

The Diocese, the Yeshiva, or some Charter school robbing you blind in the name of educating your children? There's a place for your kids -- close to home and more than capable of teaching and nurturing, with your support and fully funded programs -- in our public schools.

We all pay, as we should in a society -- in the community of human kind -- for our public institutions, be they parks, buses, or schools. We pay whether we feel that we personally benefit or not, realizing that as a people, as a nation, we all benefit when public money is used to finance the public good.

The school choice folks (funny how so many of them, it seems, are not "Pro-Choice" on other issues) have every right to send their children to private and parochial schools. Maybe they shouldn't. Perhaps it would benefit every one of us if we mandated a public education for every child.

Having made that choice, however, private over public, they should have no choice but to pay for it out of their own pockets.

Its not an entitlement, people. A public education is. A private/parochial education is not.

No tax credits. No vouchers. No taking from the public pot to pay for a private education at St. Peters, St. Pauls, or the Yeshiva of your choice.

Public Money. Public Schools. Period!

Wednesday, February 14, 2007

Advice To A Fledgling Governor From Arrrnold

Actually, we think that Governor Eliot Spitzer is savvy enough to know not only when to hold 'em and when to fold 'em, but also when to publicly hit 'em over the head with that stacked deck, and when to negotiate a workable, if not ephemeral peace.

Yes, steamrolling 'em in Albany captures the public's attention, and wins the praise of political pundits with whom such rhetoric resonates, but believe us, it gets real old, real fast.

Just take a page from the lesson book of the early days of California's Governor "I'll Be Back." Invaluable, if not humorous reading, from "I'll act without them" to girly-men."

Given that Mr. Spitizer reads The New York Times, we're sure he's not only taken notice, but has grinned at the somewhat dubious connection.

Yes, it may seem hard to be humble when you think you're as great as your inner circle says you are, but we have no doubt that Governor Spitzer will temper his steamrolling with an appropriate smattering of that proverbial pie.

There is a real difference between flexing that muscle, and actually using it. If anyone can do both -- or not -- as the moment commands, it is New York's Eliot Spitzer!

- - -

Hungry for Change, a Pair of Governors Are Served Humble Pie

By Jennifer Steinhauer

LOS ANGELES, Feb. 9 — Eliot Spitzer, the people of California have seen the likes of you before.

The reformer, the new guy in the capital, the one who is going to shake things up. He comes in with a big agenda, smacks around the State Legislature — including members of his own party — with harsh words and grand statements about his mandate.

And then he sort of cools it. That was what Gov. Arnold Schwarzenegger figured out was necessary, if one really wants to get things done.

“Both Spitzer and Arnold are viewed as Davids versus Goliaths, taking on corruption, taking on the big guys,” said Barbara O’Connor, director of the Institute for the Study of Politics and Media at California State University, Sacramento. “And in many ways they both have pledged to take back government and be an instrument of the people.”

But if recent history is any guide, Governor Spitzer may also end up like his counterpart on the West Coast, cooling his heated language, editing his battle list and embracing issues that are popular with both parties.

Like Mr. Spitzer in New York, Mr. Schwarzenegger came to the governor’s mansion in California (or, ahem, the Sacramento Hyatt Hotel) with an appetite for big change and a pair of elbows that could cut raw meat. Craving to move mountains, he faced off with an entrenched Legislature and powerful unions, letting them know he would have no truck with obstreperous ways.

And Mr. Schwarzenegger ping-ponged from early victories to watching lawmakers sock it to him at will, just as Mr. Spitzer lost the battle over the state comptroller this week.

Not long after winning a recall election in 2003, Mr. Schwarzenegger revamped the state’s costly workers’ compensation system and addressed its inveterate budget deficits.

But he also lost his fight to change labor rules and transfer budget powers to the governor’s office and redraw the state’s Congressional and legislative districts. In the heat of a budget battle, he invoked emergency powers to cut state spending, provoking further legislative ire.

When he tried to pull an end run around lawmakers and take the issues to the public, voters said no thanks, and suggested at the time that maybe he ought to spiff up his résumé.

Mr. Spitzer, barely into his second month of a term he won in a landslide victory, also started off with a quick victory. He helped his party grab a State Senate seat in a special election on Long Island. But he was just as quickly foiled by legislators who disregarded an agreed-upon selection process for a new state comptroller, picking instead among their own. He has threatened to mess with the money that fuels that state’s big health care industry.

Mr. Schwarzenegger, when displeased, reduced his opponents in the Legislature to “girly men.”

Mr. Spitzer has opted to declare his Legislature’s “stunning lack of integrity.”

It is the stuff of good headlines, but at least in the case of California, it does not last.

After his 2005 referendum defeat and through his re-election campaign the following year, Mr. Schwarzenegger took a different tack. Calling himself post-partisan, he worked with lawmakers on both sides of the aisle to win a critical bond measure. He sought environmental legislation.

And he is approaching this year’s budget with olive branches, rather than verbal cactuses.

The California governor, who once said of state legislators, “I will act without them,” addressed them this January with promises to many by name, referring to their pet issues and saying, “I will work with you.”

No doubt, there are differences between the governors and the respective states they serve.

Mr. Spitzer is widely believed to have visions of a presidential run — something the Austrian-born Mr. Schwarzenegger is barred from seeking — and so has more to gain in the long term by gilding his reputation as a reformer.

Generally speaking, California voters do not wake up every morning wondering which of their local representatives is about to be investigated, indicted or simply relegated to irrelevance in the largely debate-free legislative process that defines governing in Albany.

Mr. Schwarzenegger’s biggest problems have stemmed from his spectacularly failed ballot initiatives, a system New York does not practice.

Mr. Spitzer, unlike Mr. Schwarzenegger during his about-face, is not facing re-election any time soon, and he has picked an issue that could resonate with voters: overhauling the ethics of the capital.

So with Mr. Spitzer, it may come down to this: he succeeds at the highly unlikely task of flattening the state’s two top legislators, or he goes the Schwarzenegger route and speaks the language of compromise.

Fighting entrenched interests “are the themes that resonate with the voters,” Dr. O’Connor said.

“But as Arnold found out, the Legislature has a mind of its own. You learn that you can be rolled. And then you learn to make deals.”

Copyright 2007 The New York Times Company

Tuesday, February 13, 2007

Two Nassau County Legislators' Shining Moment

It came as a surprise to some, and a shock to others, when two members of the GOP broke the mold, exercising independent thought and the power of personal conviction, casting the only two votes in the negative, against the ambitious Nassau Hub (Coliseum) revitalization project.

Its not that County Legislators Richard Nicolello or Vincent Muscarella believe that reclaiming the hub is a bad idea. Simply put, its just a matter of the County giving up control -- from rezoning to decisions related to redevelopment -- to the Town of Hempstead.

You see, once the County Legislature signs off on the Hub renewal project -- as it did, by a vote of 16-2 -- the ball is passed to the Zoning Board of Appeals of the Town of Hempstead.

The Town -- which, as we all know, has been making a mish-mosh of zoning and development for the past 100 years when left to its own devices -- will hold all the marbles, while the County is left, well, holding the bag.

Rich Nicolello, who represents communities in the Town of North Hempstead, felt -- understandibly so -- that North Hempstead would be boxed out of any decsion-making (if you could call what the TOH ZBA does, "decision-making") once the baton passes to Hempstead Town.

Mr. Nicolello is correct.

Vin Muscarella, whose constituents chiefly reside within the borders of the Town of Hempstead -- suffering under the oppressive and archane yoke of the Town's Zoning Board of Appeals -- put it this way: "To put this before the Town of Hemsptead is an abdication of our responsibility."

Mr. Muscarella is even more correct.

Surely, Legislator Muscarella didn't really mean to offer his Republican colleagues in the Town of Hempstead a back-handed compliment, as in, "the Town will mess this up just like they do everything else."

No, he was merely averring to the fact that the County, which owns the land, would have no say over how that land, and the surrounding neighborhood, is zoned and developed.

Join the club, Mr. Muscarella. Now you know how the rest of us property owners, living under the jurisdiction of the Towns' Draconian Zoning Board, feel.

You are right, sir, even if the reasons go deeper than those you've articulated.

The Town of Hempstead can get it right -- given time (lots and lots of it) and input from the community -- but they won't.